There’s been a frenzy of M&A activity in the Permian Basin the past couple of years, and in recent months many of the acquiring E&Ps have reviewed their expanded base of assets, determined which acreage, wells and future well sites are core to their business going forward, and initiated the process of divesting the rest. At the same time, others — including some producers that were part of the merger mania — are on the hunt for what they see as underappreciated assets with the potential to shine. Folks, we’re in the early stages of what you might call “The Great Permian Reshuffling” — a rapid-fire exchange of upstream assets in the nation’s most prolific shale play. In today’s RBN blog, we discuss a few of the most noteworthy “bolt-on” deals and what they tell us.

There are several drivers behind the long list of E&P acquisitions we’ve blogged about lately, including the pursuit of greater scale, improved efficiency and higher shareholder returns. But don’t forget the production assets themselves — after all, their quality, location and developability make everything else possible. And, as we’ve said often in this space, many larger, publicly owned E&Ps (EOG Resources being a standout exception), have decided that the fastest, most cost-effective way to rejuvenate and expand their oil and gas reserves and grow their business is by buying competing producers with production assets that complement their own and, in some cases, enable the acquiring E&Ps to expand into what they see as up-and-coming production areas. Important examples include Chevron buying Hess Corp., Occidental Petroleum purchasing CrownRock, Chesapeake Energy acquiring Southwestern Energy, Diamondback Energy snapping up Endeavor Energy Resources, ExxonMobil buying Pioneer Natural Resources and, most recently, Devon Energy acquiring Grayson Mill Energy.

We’ll start with Occidental (aka Oxy), whose acquisition of CrownRock — announced in December 2023 and closed on August 1 — came with $9.1 billion in new debt and the assumption of $1.3 billion of CrownRock debt as well as two commitments by Oxy: (1) that it would reduce its debt by more than $4.5 billion within 12 months of the deal’s closing and (2) that it would divest between $4.5 billion and $6 billion in assets within 18 months of closing.

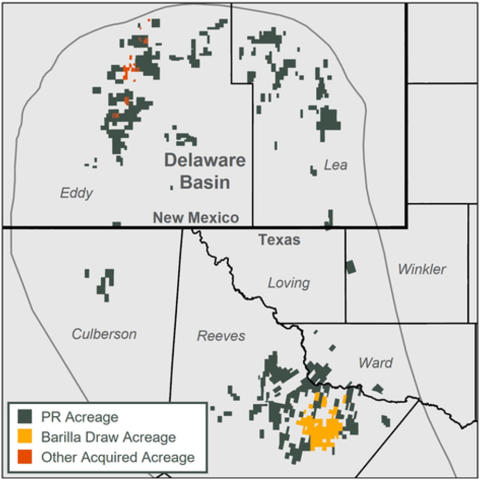

Oxy actually got a head start on its divestiture plan, announcing July 29 that it had reached an agreement to sell certain Delaware Basin assets to Permian Resources (PR) for $818 million and also inked a few unspecified asset-sale deals with others valued at a combined $152 million. As we discussed in the aptly named Eat Or Be Eaten, PR last fall acquired Earthstone Energy, which had been on an acquisition spree of its own from late 2020 to early 2022. The Earthstone deal expanded PR’s holdings in the Delaware Basin by 56,000 acres to 233,000 acres — the dark-gray areas in Figure 1 show the pro forma company’s acreage there — and gave it a foothold in the Midland Basin, where Earthstone controlled 167,000 acres.

Permian Resources’ Existing and To-Be-Acquired Acreage in the Delaware Basin

Figure 1. Permian Resources’ Existing and To-Be-Acquired Acreage in the Delaware Basin.

Source: Permian Resources

Join Backstage Pass to Read Full Article