It’s only natural that deals like Chevron’s $7.6 billion acquisition of PDC Energy and ExxonMobil’s $4.9 billion purchase of Denbury grab the market’s attention. After all, the buyers are names known to everyone — even those who only think about hydrocarbons when they’re filling up at their local gas station. But a lot of other, lower-profile M&A action is happening too, especially in the Permian and also in the Eagle Ford. You might say these are cases of “Eat or be eaten” — or, in one recent case, “Eat and be eaten.” In today’s RBN blog, we discuss the plans by Permian Resources to acquire Earthstone Energy; Civitas Resources to buy assets in the Permian’s Delaware and Midland basins from Tap Rock Resources and Hibernia Resources, respectively; and SilverBow Resources to scoop up Chesapeake Energy’s last remaining assets in the Eagle Ford.

We had been anticipating through the late 2010s that there would be a major consolidation among E&Ps as the oil and gas industry matured, private-equity-backed producers cashed in, and leading E&Ps sought to optimize their efficiency by scaling up their operations. The M&A boom had started and since then, we’ve discussed many of the most interesting deals in the RBN blogosphere — so far in 2023, we’ve posted Harder, Better, Faster, Stronger, Come Back Song and What I Like About Texas, not to mention recent, deal-specific blogs on Chevron/PDC, which will give Chevron a strong foothold in the Denver-Julesburg (DJ) Basin, and ExxonMobil/Denbury, which will propel Exxon forward in the super-hot specialty of carbon capture and sequestration (CCS).

Permian Resources/Earthstone Energy

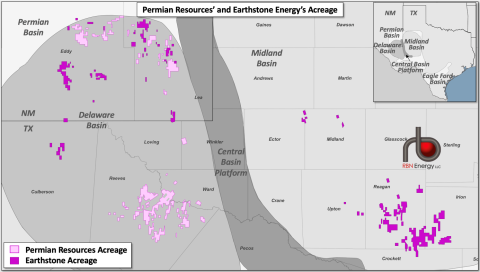

Well, the M&A keeps comin’, as evidenced most recently by Permian Resources’ announcement last Monday (August 21) that it will acquire Earthstone Energy — itself the focus of an M&A blog last year — in an all-stock deal valued at about $4.5 billion. As shown in Figure 1, Permian Resources is already a significant player in the Permian’s Delaware Basin, where it controls about 180,000 net acres (light pink areas) — mostly in West Texas’s Reeves and Ward counties and southeastern New Mexico’s Eddy and Lea counties —and produces about 166,000 barrels of oil equivalent per day (166 Mboe/d). Earthstone, in turn, has about 223,000 net acres (dark pink areas) — 56,000 of them in the Delaware and 167,000 in the Midland Basin — and produces about 133 Mboe/d. Most of Earthstone’s acreage and production is in Eddy County (NM) and Culberson County, TX, in the Delaware and West Texas’s Reagan and Irion counties in the Midland.

Figure 1. Permian Resources’ and Earthstone Energy’s Acreage. Source: Permian Resources

Join Backstage Pass to Read Full Article