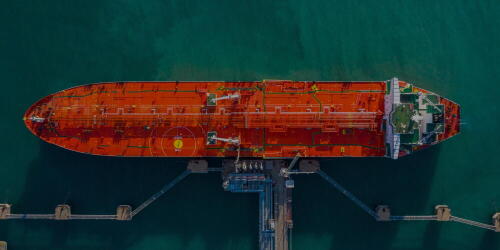

U.S. - Japan Trade Deal Channels Billions Into Gas-Fired Power and Offshore Crude Export Projects

President Trump announced on Tuesday, February 17, a $550 billion trade agreement between the United States and Japan, with roughly $36 billion allotted for U.S. oil, gas, and critical mineral projects.