RBN Consulting Services

RBN’s consultants bring clarity to today’s complex and fast-moving energy markets. Our team works across the value chain in natural gas, crude oil, NGLs, refined products, and renewables to help clients assess risk, evaluate opportunities, and make informed decisions.

We provide a full spectrum of services, from supply and demand fundamentals and price forecasting to expert witness testimony and regulatory support. Each engagement combines extensive market expertise with a practical, results-oriented approach.

Trusted by producers, midstream operators, refiners, utilities, and financial institutions, our team is ready to put decades of hands-on experience to work for you.

Capabilities

Market Analytics

- Commercial Strategy

- Transaction Due Diligence

- Infrastructure Analytics

- Energy Market Models

- Flow/Capacity Analysis

Regulatory and Litigation

- Rate case Filing

- Litigation and Settlements

- Regulatory Studies and Strategic Advice

- Energy Civil Litigation

- Energy Expert Witness

Speaking Engagements

- Board Meetings

- Customer Meetings

- Management Presentations

- Conferences

- Internal Team Development

Our Approach

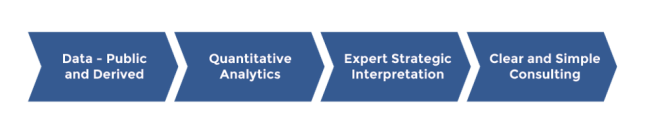

This data-driven starting point is depicted in the graphic below. We then analyze the data using quantitative methods and models, which provide the basis for our expert strategic interpretation of the data. This commercial interpretation is accomplished by RBN’s senior executive team based on decades of practical, hands-on, direct involvement in U.S. energy markets. Finally, we integrate our analysis into a clear and simple consulting service that includes management level presentations with access as necessary to all supporting data and evaluations.

It has been RBN’s experience with multiple clients that RBN’s combination of deep, fundamentals-based analytics with outstanding communication and presentation approaches has provided genuinely valuable strategic input for major management decisions.

Customers

Infrastructure Funds

Refineries

Pipelines

Law Firms

Marketers

Producers

Shipping

Government

Internationals

And Many More

Consulting Case Studies

- Produced Independent Market Reports supporting multimillion-dollar financings and asset sales, including detailed outlooks for U.S. gasoline and octane competition as well as refined fuels demand in Mexico.

- Delivered comprehensive NGL supply and demand assessments, including production growth, fractionation capacity, and infrastructure stress points that influence long-term pricing and market balance.

- Built forward-looking natural gas market forecasts for Texas and Louisiana, highlighting LNG export impacts on pipeline flows, basis at Waha and Katy, and balance shifts along the Gulf Coast.

- Developed independent valuations of key gasoline blendstocks and petrochemical byproducts, supporting financing decisions with monthly assessments going forward 20 years.

- Produced independent market studies for natural gas infrastructure projects, supporting FERC certificate applications by demonstrating supply-demand fundamentals and long-term system need.

- Provided expert analysis and testimony in royalty disputes, particularly for shale gas production with NGL-rich content, clarifying cost treatment and valuation issues for courts and regulators.

- Delivered prudence reviews and testimony for utilities during extreme market events, analyzing procurement practices and supply strategies to defend cost recovery before regulators.

- Acted as expert witnesses in contract disputes, evaluating gas supply obligations and market performance to support resolution in high-stakes federal litigation.

- Managed FERC rate case filings for small producer-oriented pipelines, offering the same level of rate department expertise available to larger systems to ensure regulatory compliance and favorable outcomes.

- Guided refiners in developing crude acquisition strategies, weighing production volumes, transportation alternatives, and evolving pipeline flow trends to optimize supply portfolios and manage price differentials.

- Helped producers assess risks tied to takeaway capacity constraints across the Permian, Rockies, and Marcellus/Utica, enabling proactive drilling and marketing strategies.

- Supported utilities and midstream companies evaluating entry into new business lines, including NGLs and renewable fuels, by analyzing supply growth, demand drivers, and competitive positioning.

- Advised on opportunities in heavy crude, asphalt, and renewable fuels markets by combining demand forecasts, trade flow modeling, and policy impact scenarios to identify growth avenues.

- Delivered due diligence for pipeline and processing facility investments, including analysis of contracts, flow patterns, and market competitiveness to inform asset valuations.

- Produced Independent Market Reports and long-term market forecasts that underpinned financing efforts for refining and petrochemical projects, supporting both lenders and buyers in transaction processes.

- Conducted in-depth analysis of the Cushing, OK crude oil hub, including pipeline interconnections, storage operations, and quality segregation, enabling clients to make informed investment decisions.

- Supported transaction strategies with valuations and sensitivity analyses across refined products, crude logistics, and NGL infrastructure, providing clarity in evolving market conditions.

- Analyzed Gulf Coast natural gas markets to support LNG terminal development, modeling supply options from the Permian and assessing LNG export effects on regional balances and hub pricing.

- Delivered insights into U.S. NGL infrastructure, including fractionation bottlenecks and pipeline constraints, helping clients anticipate where production growth might stress logistics systems.

- Assisted in refinery restart planning by developing operating scenarios, assessing economics of alternative configurations, and navigating regulatory and financing challenges.

- Evaluated logistics strategies for multi-facility refiners, aligning crude supply sources and transportation systems with market developments to improve long-term competitiveness.

- Built detailed gas supply and demand models for Texas and Louisiana, forecasting how LNG export volumes reshape pipeline flows, price differentials, and regional balances.

- Modeled Mexico’s refined fuels import requirements and U.S. Gulf Coast export opportunities, providing clarity on long-term cross-border trade dynamics.

- Developed integrated NGL models covering production growth, fractionation economics, takeaway capacity, and demand shifts across key basins.

- Created scenario-driven models of crude logistics to stress test refiner acquisition strategies under different supply, demand, and midstream development conditions.

- Conducted pipeline flow studies for the Upper Midwest, incorporating Canadian, Rockies, and Permian supplies, to assess market balance risks and basis exposure.

- Evaluated crude flows at major hubs such as Cushing, mapping pipeline interconnectivity and storage dynamics critical to both commercial and regulatory strategies.

- Identified risks of pipeline takeaway constraints for crude oil, NGLs, and natural gas in growth basins, helping producers anticipate bottlenecks and protect margins.

- Analyzed refined product logistics and storage opportunities, including heavy crude and asphalt, by combining capacity assessments with forward-looking demand and policy scenarios.

Speaking Engagement Cases Studies

- Delivered a keynote presentation at an industry conference, providing an outlook for NGL markets and infrastructure dynamics.

- Presented to a board of directors, covering the outlook for crude oil, natural gas, and NGLs with emphasis on Permian and Haynesville flows.

- Led a multi-session program for a business development team, addressing NGL fundamentals and ethane’s evolving role in petrochemical and global markets.

- Spoke at an executive management meeting, focusing on Permian crude flows, pipeline utilization, and the impact on U.S. export positioning.