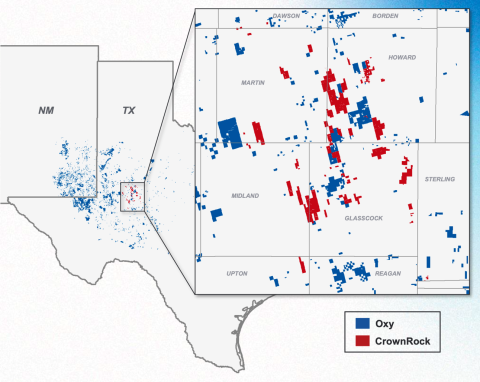

It may be considerably smaller in scale than the recent ExxonMobil/Pioneer and Chevron/Hess megadeals, but Occidental Petroleum’s announcement that it will acquire privately held CrownRock LP for $12 billion is remarkable in its own right. Among other things, the deal will give Delaware Basin-focused Oxy a strong foothold in the absolute core of the Midland Basin, supercharge its free cash flow and — despite increasing Oxy’s debt in the short term — provide a pathway for the company to return much more money to shareholders via dividends and stock buybacks in the years ahead. In today’s RBN blog, we examine Oxy’s planned acquisition of CrownRock and what it means for the acquiring company and the Permian itself.

Production-asset consolidation in the Permian has been a primary theme in a number of our blogs over the past couple of years, ExxonMobil’s planned $64.5 billion acquisition of Pioneer Natural Resources being the most recent — and most obvious — example. There are, of course, good reasons for the consolidation trend, most important the facts that (1) the Permian is far and away the U.S.’s most prolific megabasin, with vast reserves of crude oil, natural gas and NGLs only a stone’s throw from Gulf Coast refineries, fractionators, petrochemical plants and export terminals, and (2) much larger scale enables producers to drive down their production costs and increase their free cash flow generation, profitability, and desirability to investors.

Figure 1. Occidental’s and CrownRock’s Acreage in the Permian. Source: Oxy

Join Backstage Pass to Read Full Article