A Super Bowl game (and halftime show) for the ages followed up only hours later by a made-in-heaven combination of two of the largest, most admired E&Ps in the super-hot Permian? It doesn’t get any better than this, unless you’re a Taylor Swift fan too — in which case, it may be impossible for you to “shake it off.” In today’s RBN blog, we examine the newly announced plan by Diamondback Energy and Endeavor Energy Resources to combine into a Travis Kelce-sized Permian pure play with more than 800 Mboe/d of crude oil-focused production and more than 6,000 well locations with breakevens of $40/bbl or less.

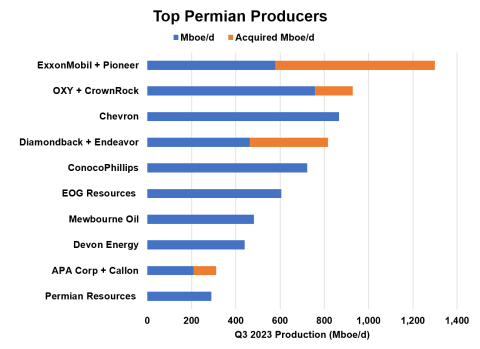

As we recently documented in Keep on Dancing, upstream M&A soared to $192 billion in 2023, a mark 79% above the previous 10-year high and more than the previous three years combined. The Permian accounted for $103 billion of that total, headlined by ExxonMobil’s $59.5 billion purchase of Pioneer Natural Resources — the combined company will produce a basin-leading 1.3 MMboe/d upon closing. In mid-December, Occidental Petroleum announced the $12 billion acquisition of privately held CrownRock, creating a pro forma entity that will leapfrog Chevron, ConocoPhillips and EOG Resources to take the #2 spot among Permian producers. And consolidation fervor scarcely slowed in early 2024 with the January announcements of APA Corp.’s $4.5 billion purchase of Permian producer Callon Petroleum and Chesapeake Energy’s $11.5 billion deal for fellow gas producer Southwestern Energy.

Now, February has produced the third-largest of the recent onslaught of upstream deals — after ExxonMobil/Pioneer and Chevron’s $53.5 billion purchase of Hess Corp. Diamondback Energy (stock symbol: FANG), the seventh-largest public U.S. E&P and second-largest Permian pure-play producer (after Pioneer), will acquire Endeavor Energy Resources for 117.3 million shares of FANG stock, $8 billion in cash, and assumption of about $1 billion in net debt. The pro forma profile of the combined company includes:

- A 72% increase in Diamondback’s enterprise value, to $62 billion.

- A 76% rise in the E&P’s Q4 2023 production to 816 Mboe/d and a 71% jump in oil output to 468 Mb/d.

- A doubling of Diamondback’s net Midland Basin acres to 694,000 and a 70% increase in total Permian net acres to 838,000.

- A 61% increase in gross locations with a sub-$40/bbl oil price to 6,100.

- A 74% increase in Diamondback’s proved reserves, to 3.5 billion boe.

After the expected close of the transaction in Q4 2024, the company will be the fourth-largest Permian oil and gas producer, behind only ExxonMobil/Pioneer, Occidental/CrownRock, and Chevron (see Figure 1 below; note that Chevron’s acquisition of Hess will not add to Chevron’s Permian production volumes.)

Figure 1. Top Permian Producers (After Recently Announced Deals Close).

Source: Oil & Gas Financial Analytics

Join Backstage Pass to Read Full Article