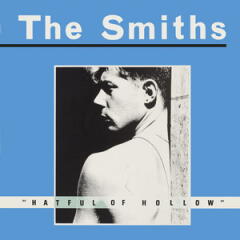

Save Room – Existing and Planned Natural Gas Storage Facilities in East Texas and West Louisiana

“Location, location, location” doesn’t just apply to residential and commercial real estate.

RBN’s Daily Energy Blog and Insights sharpen your energy IQ through fundamentals-based analysis that makes sense of North America’s energy market dynamics.

“Location, location, location” doesn’t just apply to residential and commercial real estate.

The world is hungry for more natural gas. But where will it come from and what are the biggest issues facing the market? Those are among the major questions addressed at GasCon 2026 and the focus of today’s RBN blog.

New and expanded natural gas storage facilities near the Texas/Louisiana border are coming online and being planned, mostly in response to the ongoing buildout of LNG export capacity along the Gulf Coast and new gas pipelines to those terminals.

All 40 electrolyzers at the ACES Delta storage hub in Utah have been installed and have operated at 100% load, HydrogenPro, the site’s electrolyzer supplier, said during its Q4 2025 earnings call on February 27.

Cheniere discussed the timeline of the Stage 3 project at Corpus Christi and the Midscale Trains 8 and 9 during its earnings report this week.

The fundamentals of the natural gas market have never been better, but the continued buildout of midstream infrastructure remains critical to meeting supply-and-demand needs in the coming years, a trio of industry experts said during a panel discussion Wednesday at RBN’s GasCon 2026 conference in

Two giant natural gas producers and an analytics expert are hopeful natural gas will remain available to meet growing demand, but logistical and infrastructure challenges will shape how smoothly they can get it to market.

The Future of Fuels bi-annual report by RBN's Refined Fuels Analytics provides an in-depth analysis of the U.S. and global refinery industries, focusing on crude oil and fuel market dynamics, supply and demand, alternative fuels, refinery capacities, and price forecasts to help stakeholders navigate the evolving energy landscape.

In Wednesday’s keynote presentation, Dan Brouillette, the 15th Secretary of the U.S.

Policy choices can have a major impact on project development and regulatory certainty is a key factor in the recent growth in the LNG industry, Tala Goudarzi, a Torridon Group partner and former Department of Energy (DOE) official, said during a fireside chat with RBN President and CEO David Bra

New LNG export capacity near the Texas/Louisiana border, rising natural gas production in the Haynesville (and the West Haynesville), and new pipelines transporting that gas south to the Gulf Coast have spurred a lot of interest in gas storage — and storage developers are responding.