Rumors about potential oil and gas mergers are always swirling, but the announcement of ExxonMobil’s record-breaking deal to acquire Pioneer Natural Resources a couple of weeks ago generated a fever pitch of speculation about potential matchups. In the past week, we’ve seen media reports of possible courtships between Devon Energy and Marathon Oil and then Chesapeake Energy and Southwestern Energy. However, it was Chevron that shocked the oil patch by swiping right on former integrated oil company Hess Corp., opting for a $60 billion acquisition of an E&P with no Permian Basin exposure. In today’s RBN blog, we analyze the drivers and implications of what is now the second-largest U.S. upstream transaction ever.

Chevron, the #2 global integrated oil company with a market cap of $311 billion, had been expected to respond to the dramatic acquisition by #1 ExxonMobil, and speculation logically focused on a move to boost scale in the Permian Basin. In contrast with peers that have focused on shale-related acquisitions, Chevron has been developing the substantial legacy position created with its 2000 merger with Texaco. The company’s Q2 2023 output of 772 Mboe/d placed it second among Permian producers, well ahead of ExxonMobil’s 560 Mboe/d. The company’s aggressive development plan targeted 1 million boe/d of Permian production by 2025, well ahead of its larger competitor’s goal of reaching that level by 2027, but the Pioneer acquisition will catapult ExxonMobil to 1.3 billion boe/d. Would Chevron respond with a Permian deal of its own?

The answer was no, and a close look at the company’s recent acquisition history clearly shows why turning in another direction shouldn’t be a surprise. But first, let’s take a quick look at the newly announced deal. Chevron is acquiring Hess Corp. for $53 billion in stock, or a total of $60 billion including assumed debt. The $171/share implied value is a 10.3% premium to Hess’s 20-day average closing price on October 20 and a 5% premium to the price the day before deal announcement.

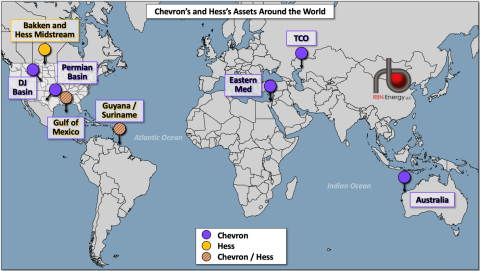

Hess’s premier asset is its 30% interest in ExxonMobil-operated production contracts offshore Guyana, the world’s largest oil discovery in the last 10 years. The Stabroek block currently has 11 billion boe of gross discovered recoverable resources and is producing 110 Mboe/d net to Hess from the first two floating production, storage and offloading platforms (FPSOs), with a potential for up to 10 FPSOs over the next decade. Hess has been funding the Guyana development from cash flow from its Bakken Shale acreage, which is currently producing 180 Mboe/d and is supported by substantial midstream infrastructure. The company also reported 30 Mboe/d from the deepwater Gulf of Mexico and 65 Mboe/d in natural gas output from Southeast Asia. Chevron said the Hess transaction will be accretive to its cash flow per share in 2025 and boosted its estimated five-year free cash flow growth after generating an estimated $1 billion in annual operating synergies. Chevron announced it expects to increase its dividend by 8% in Q1 2024 and will increase its annual share repurchases from $17.5 billion to $20 billion.

Figure 1. Chevron’s and Hess’s Assets Around the World. Sources: Chevron, Hess

Join Backstage Pass to Read Full Article