Sometimes, courtship is better the second time around. After some previous rumors and flirting with a deal in the spring of 2023, ExxonMobil, the largest international integrated oil company, reached an agreement to acquire Pioneer Natural Resources, the largest pure-play Permian producer, for $64.5 billion, the largest-ever U.S. upstream transaction. In today’s blog, we analyze the deal that would make ExxonMobil the top Permian producer, including shifts in the focus and depth of its upstream portfolio, the integration with its existing midstream and downstream infrastructure, and its energy transition goals.

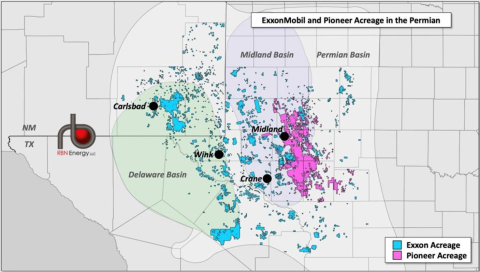

First, let’s look at the headline metrics of this historic transaction. The major integrated oil producer has agreed to acquire Pioneer Natural Resources (PXD) in an all-stock transaction valued at $253 per Pioneer share based on ExxonMobil’s closing price on October 5, an 18% premium to PXD’s closing price on the same date. The total value is $64.5 billion, including assumption of net debt, nearly $8 billion higher than Occidental Petroleum’s $57 billion 2019 acquisition of Anadarko Petroleum. More impressively, the equity portion of ExxonMobil’s purchase is $59 billion, $21 billion higher than the $38 billion Oxy paid for Anadarko’s equity. Pioneer’s Q2 2023 production of 711 Mboe/d more than doubles ExxonMobil’s current output of 600 Mboe/d for a combined production of 1.3 MMboe/d, vaulting the buyer into the position of top Permian producer. As shown in Figure 1, Pioneer’s 850,000 net acres in the Midland Basin (pink-shaded areas) are highly contiguous to ExxonMobil’s current Midland acreage (blue-shaded areas), which the buyer estimates will generate average annual synergies of $2 billion over the next decade. Combined production is expected to reach 2 MMboe/d in 2027 from a resource base of 16 billion barrels of oil equivalent (boe) that provides 15-20 years of remaining inventory. The transaction, which is expected to close in the first half of 2024, will be immediately accretive to ExxonMobil’s earnings per share, operating cash flow, and free cash flow and will enhance shareholder capital returns.

Figure 1. ExxonMobil and Pioneer Acreage in the Permian. Source: RBN

Join Backstage Pass to Read Full Article