Even with all the headline-making deals we’ve seen in the North American oil and gas industry over the past two or three years, producers and midstream companies are still at it. And the M&A, the post-acquisition divestitures and the acreage swaps aren’t confined to the Permian, which has seen more than its share of big-dollar transactions lately. In fact, as we discuss in today’s RBN blog, some of the biggest deals the past few months have involved production assets in the booming Montney in Western Canada, the generally sleepy Piceance in western Colorado, the quirky-as-heck Uinta in Utah, and — on the midstream side of things — a trio of natural gas pipelines in the Midwest.

Given that we live and breathe music — and hydrocarbons! — at RBN, we’re amidst perhaps the biggest consolidation ever among oil and gas producers and midstreamers, so it might be time for us to work up a Top 40 list of the biggest deals. If we did, the #1 spot would go to ExxonMobil acquiring Pioneer Natural Resources ($64.5 billion), followed by Chevron buying Hess Corp. ($60 billion) and Diamondback Energy snapping up Endeavor Energy Resources ($26 billion). Many more multibillion-dollar deals are behind them, including Coterra Energy’s recently announced, nearly $4 billion plan to purchase oil-focused Permian assets from Franklin Mountain Energy and Avant Natural Resources. In addition to tracking straightforward M&A deals, we’ve also been keeping tabs on the almost inevitable follow-up to acquisitions — namely, the divestiture of non-core assets (in part to reduce debt), which we discussed most recently in Time to Say Goodbye and Shake It Off.

This time, we’ll be looking at a variety of recently announced transactions, beginning with Ovintiv’s (stock symbol OVV) November 14 announcement that it had entered into a definitive purchase agreement to acquire “certain Montney assets” from Paramount Resources Ltd. in an all-cash transaction valued at about C$3.325 (US $2.377 billion). Ovintiv also will exit the Uinta Basin via an agreement to sell virtually all its assets to FourPoint Resources LLC for $2 billion in cash. (More on that deal in a moment.)

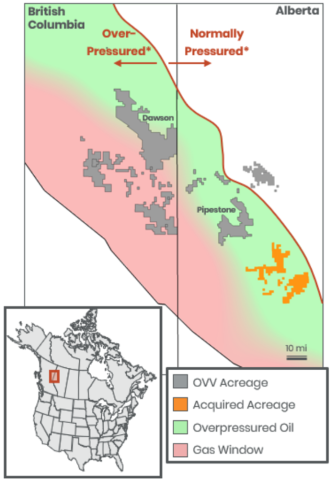

Ovintiv’s Montney deal, which is expected to close in Q1 2025, will add 109,000 net acres (orange area in Figure 1 below) on the Alberta side of the Montney’s over-pressured oil window to Ovintiv’s current 260,000 net acres in the play (gray areas), a significant portion of which is located on the gassier side of the Montney. (Note: The green area in the map shows the Montney’s over-pressured oil window, the red area shows the gas window, the vertical black line shows the Alberta/British Columbia (BC) border, and the red line shows the eastern boundary of the over-pressured oil window.)

Ovintiv’s Existing and To-Be-Acquired Acreage in the Montney

Figure 1. Ovintiv’s Existing and To-Be-Acquired Acreage in the Montney. Source: Ovintiv

Join Backstage Pass to Read Full Article