The multibillion-dollar acquisitions that have become almost routine in the upstream sector the past few years are typically accompanied by asset rationalization — in other words, a thoughtful look at which elements of the pro forma company make sense followed by the divestiture of those that don’t. In many cases, a key aim of that rationalization process is trimming any debt associated with the acquisition itself. In today’s RBN blog, we’ll discuss the big steps Chevron has been taking to rework its portfolio — and sell off up to $15 billion in assets — as it inches toward closing on its $60 billion purchase of Hess Corp.

ExxonMobil’s $64.5 billion acquisition of Pioneer Natural Resources ($59.5 billion in stock plus the assumption of $5 billion of Pioneer debt), which closed in May, may be the biggest individual upstream deal ever. But when you add ’em up, Chevron’s M&A hat trick — Noble Energy ($13 billion; closed in October 2020), PDC Energy ($7.6 billion; closed in May 2023) and, most recently, Hess Corp. ($60 billion; closing sometime next year) — gives the second-largest descendant of Standard Oil bragging rights as the #1 upstream acquirer in recent history, with deals totaling more than $73 billion, including the assumption of a combined $17.5 billion of debt.

The Noble deal gave Chevron 92,000 net acres and 67 Mboe/d of production in the Permian’s Delaware Basin, but the crown jewel was Noble’s international assets, especially the Leviathan project offshore Israel, the largest natural gas field in the Eastern Mediterranean, and the Alen gas project offshore Equatorial Guinea. Noble’s major U.S. asset was its holdings in the Denver-Julesburg (DJ) Basin in Colorado, where Noble was the second-largest producer. The PDC Energy deal gave Chevron additional heft in the DJ — another epicenter of M&A activity — where Chevron is now the #1 producer, with output averaging more than 165 Mboe/d so far this year.

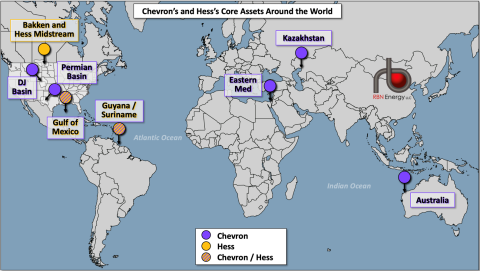

As for the Hess acquisition — whose major prize for Chevron is a 30% ownership interest in the Stabroek crude oil project off the coast of Guyana — it’s still a work in progress. (Figure 1 below shows the core assets that Chevron and Hess bring to the deal.) When Chevron announced the agreement last October, it said it expected to close the transaction in the first half of 2024. But ExxonMobil, the operator and 50% owner of the Stabroek project, and China’s CNOOC, which owns the remaining 20%, asserted that they hold rights of first refusal (ROFRs) for Hess’s 30% stake, throwing Chevron’s acquisition of that asset into doubt. (As we noted in Break My Stride, a three-person arbitration panel will hear the matter in May 2025 and likely issue a ruling two or three months later.) Also, there were delays in securing the Federal Trade Commission’s (FTC) blessing for the Chevron/Hess deal, though that finally came in late September — albeit with a requirement that Hess CEO John Hess not be appointed to Chevron’s board of directors.

Figure 1. Chevron’s and Hess’s Core Assets Around the World. Source: RBN

Join Backstage Pass to Read Full Article