It’s no secret that the past several months have been challenging for the wind power industry, especially when it comes to offshore projects. Major developers have sought to renegotiate power-purchase agreements (PPAs) signed years ago, delayed work on some projects, and walked away from others, despite severe financial repercussions in some cases. On top of all that, only one of three offshore tracts available in the U.S.’s first Gulf of Mexico lease auction for wind power attracted any bids. It all amounts to a major setback in the Biden administration’s goal for the nation’s electricity to be 100% carbon-free by 2035. In today’s RBN blog, we look at the significant challenges being faced by wind power developers, what they mean for the projects currently under development, and some changes that could eventually help bring more of the renewable power online.

We’ve written a lot over the past couple of years about how the ongoing energy transition isn’t going to be a straight line leading directly to abundant, carbon-free power and a net-zero world. The increased deployment of electric vehicles (EVs), the development of large-scale carbon-capture projects, and the creation of a flourishing clean hydrogen industry are all seen as important elements in a cleaner energy economy with significant long-term potential, but each faces their own headwinds to widespread adoption and long-term growth. For offshore wind, the tune is mostly the same, even if some of the notes are a little different.

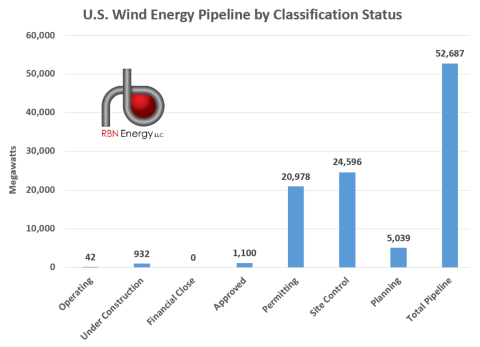

On the positive side, U.S. offshore wind development has been growing at a crisp pace in recent years. The project development pipeline (see Figure 1 below) was at 52,687 megawatts (MW) as of May 31, 2023, according to the Department of Energy’s (DOE’s) annual Offshore Wind Market Report, up 15% from the previous year. In addition, the first two commercial-scale offshore wind power plants in the U.S. — Vineyard Wind 1 and South Fork Wind — have achieved major milestones this year. Vineyard Wind 1, which is located about 15 miles south of Massachusetts’s Martha’s Vineyard, completed installation of its offshore substation in July and its first turbine was shipped to its location in early September. The project is expected to begin generating power in October. (Vineyard 1 is a 50/50 partnership of Copenhagen Infrastructure Partners and Avangrid Renewables.) Construction on the South Fork Wind Farm, located between Martha’s Vineyard and the eastern end of New York’s Long Island, began in 2022 and it is expected to begin operations before the end of 2023. (South Fork is a 50/50 partnership of Ørsted and Eversource.)

Figure 1. U.S. Offshore Wind Energy Pipeline by Classification Status as of May 31, 2023.

Source: Offshore Wind Market Report

Join Backstage Pass to Read Full Article