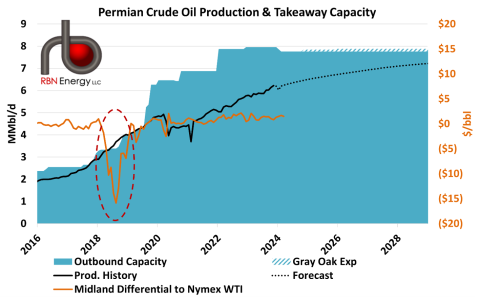

Crude oil output in the Permian Basin is now averaging 6.3 MMb/d, up about 400 Mb/d from year-ago levels and 800 Mb/d from April 2022. The gains — and related increases in associated gas — have spurred a new round of concerns about pipeline exit capacity, complicating drillers’ hopes to boost crude production. In today’s RBN blog, we will discuss the takeaway capacity issue and what it means for producers and pipeline operators, including those planning offshore crude export terminals.

Permian E&Ps want to increase their crude oil production, but they are hemmed in — and at least a tad hesitant. As producers in West Texas and southeastern New Mexico know all too well, crude production growth can only happen if there is sufficient pipeline capacity in place to move not only the oil they extract, but also the massive volumes of associated gas that emerge with it. As we discussed recently in Come Dancing, takeaway capacity for gas is once again at the knife’s edge, and there really are no good alternatives to piping that incremental gas to market — for most producers, flaring at scale is no longer an acceptable. Luckily, there’s at least one gas-takeaway fix in the short-term: The greenfield, 2.5-Bcf/d Matterhorn Express gas pipeline will come online later this year.

But while Matterhorn will help, it’s likely to fill up quickly, meaning even more gas takeaway will be needed to keep crude production growing through the next decade. That may include the expansion of the Gulf Coast Express (GCX) system as well as installing some new pipes (See Come Dancing for our projections of new gas pipe capacity). Assuming that new gas pipeline capacity out of the Permian is added as needed, crude oil production growth in the basin will eventually drive the need for more takeaway capacity, especially to major Gulf Coast oil hubs. That growth could also drive the development of one or more of the new deepwater export terminals being planned off the Texas coast, which could spur additional pipeline capacity to feed those terminals.

Figure 1. Permian Crude Oil Production & Takeaway Capacity, With Midland Differential to NYMEX WTI.

Sources: Bloomberg, RBN

Join Backstage Pass to Read Full Article