With many years gone by and many millions of dollars spent, the deepwater crude oil export projects under development along the U.S. Gulf Coast are finally getting close to receiving their regulatory green light. These projects have sparked commercial and wider market interest because of the many benefits they may provide — including the ability to fully load the biggest tankers, the Very Large Crude Carriers (VLCCs) capable of taking on 2 MMbbl, which could contribute to lower per-barrel shipping costs. In today’s RBN blog, we kick off an offshore oil terminal series, starting with the case for constructing at least one of the export projects.

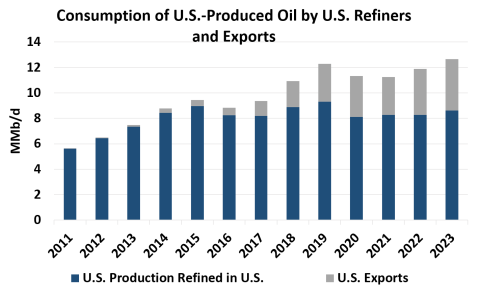

To say the U.S. crude oil market has undergone a transformation over the last 15 years would be an understatement. The Shale Revolution has allowed producers to unlock volumes that were unimaginable to many not long ago, especially in the champion of U.S. production areas — the Permian Basin. As U.S. production volumes grew (stacked bars in Figure 1), refineries started consuming their fill (solid-blue segments of stacked bars). But even as production kept growing and refineries became satiated, U.S. crude oil exports were largely limited to Canada, causing concern at the time that the shale renaissance could hit a wall. Then, in June 2014, the U.S. government opened the door for processed condensate — and eventually crude oil in December 2015 — to be exported (solid-gray segments of stacked bars). As we’ve blogged about frequently (See May Exports Be With You), export volumes took off and are expected to continue growing along with U.S. production throughout the 2020s, eventually stressing the ability of existing export terminals along the Gulf Coast to keep up.

Figure 1. U.S. Crude Oil Production, Volumes Refined and Volumes Exported. Source: RBN

Join Backstage Pass to Read Full Article