It’s that time of year, folks! March Madness is upon us — time to reboot the office pool and fill out your brackets. And not just for the NCAA Tournament field announced Sunday night, but for the natural gas pipeline projects out of the Permian you think will make it to the Elite Eight or even the Final Four. Matterhorn Express is like the UConn of the bunch as the reigning men’s champ with a chance of repeating — it’s already under construction and slated to come online later this year — and the odds for a Gulf Coast Express expansion look mighty good too, just like record scorer Caitlin Clark and her Iowa Hawkeyes are hoping to build on last year’s run to the women’s championship game. And don’t forget Energy Transfer’s Warrior and Targa’s Apex! Their names alone suggest a fightin’ spirit and a desire to make it to the top. But as we all know from our past bets on the Big Dance, there’s no such thing as a sure thing, especially in the topsy-turvy world of midstream project development, and it’s entirely possible an unknown — the pipeline equivalent of a 16th seed — will be among those cutting down the nets. In today’s RBN blog, we discuss the need for new gas pipeline egress from the Permian and assess the pros and cons of the projects that have a bid.

The Permian is second only to the Marcellus/Utica in natural gas production, but extremely different factors are at play in those two regions. Appalachian output is gas-driven — that’s why leading E&Ps there (like EQT Corp. and Chesapeake Energy) recently announced big production cuts in response to painfully low gas prices. The Permian, in sharp contrast, is laser-focused on crude oil, and that crude emerges from West Texas and Southeast New Mexico wells with vast amounts of associated gas that needs to be separated into NGLs and pipeline-quality natural gas then piped to market, either to gas consumers within the Permian itself, to other domestic markets (including LNG export terminals along the Gulf Coast), or to Mexico. Most important to our discussion today, sufficient gas pipeline capacity out of the Permian needs to be in place to handle the ever-increasing volumes coming out of gas processing plants — flaring at scale isn’t an option — and if that capacity isn’t available crude oil production growth in the basin will come to a screeching halt.

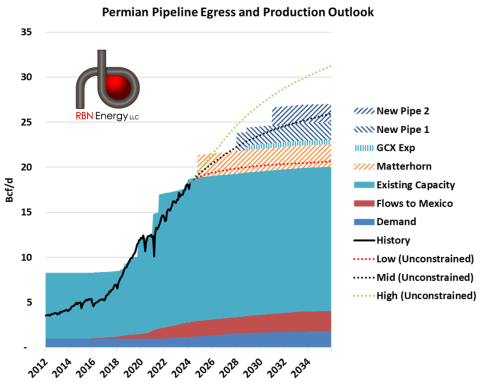

Luckily for producers, by the early days of the Shale Era, the Permian had a long history of conventional oil and gas production — and lots of pipeline takeaway capacity to handle the rising volumes of gas being produced via horizontal drilling and hydraulic fracturing through the mid-2010s (black line and teal layer to far left in Figure 1 below). Then, when Permian gas output really took off in 2016-18, those older gas pipes quickly filled up and new pipelines were planned, contracted for and built, often on the heels of periods where local gas prices were being hammered due to restricted egress (see Don’t Dream It’s Over). These included large-diameter pipes to power generators, petrochemical complexes and LNG export facilities, and to Mexico, which was bringing online a slew of new gas-fired power plants and new gas pipelines from the U.S./Mexico border to feed them.

Figure 1. Permian Natural Gas Production and Pipeline Egress. Source: RBN

Join Backstage Pass to Read Full Article