The Corpus Christi crude oil market is pulling as much volume as it can from the Permian Basin via pipelines that are running nearly at capacity. That explains why two midstream companies are responding with plans to boost the capacities of their respective pipelines from the Permian to refineries and export terminals in the Corpus area. But the situation is complicated by the very real possibility that one or more deepwater export facilities capable of fully loading a Very Large Crude Carrier (VLCC) may be built off the Texas coast. In today’s RBN blog, we’ll examine current and proposed pipeline takeaway capacity out of the Permian and the potential for proposed offshore export facilities to impact pipeline flows from West Texas to the coast.

Before we get into this topic, let’s recap the highlights in Part 1 of this series. In that piece, we emphasized that producers must have sufficient takeaway capacity to handle their rising volumes of crude oil and associated gas. Gas takeaway constraints are already here, and the industry is eagerly anticipating the ramp up of a new pipeline: the 2.5-Bcf/d Matterhorn Express (see Life in the Fast Lane), which will come online later this year. However, still more gas takeaway capacity will be needed to keep up with the Permian’s growth trajectory (see our Around the Bend series) and several projects are in the running to provide that (see Come Dancing).

For crude oil, at first glance, Permian’s drillers would seem to have enough pipe capacity to send barrels out of the shale patch. After all, production now stands at about 6.3 MMb/d and total pipeline capacity out of the play totals 7.8 MMb/d (including about 1.2 MMb/d to Cushing, OK), leaving the basin with nearly 2 MMb/d of unused takeaway space once you account for about 400 Mb/d of in-region refinery demand. The catch — and there’s always a catch, right? — is that some destination markets are more attractive than others. Also, while Permian crude oil production growth has been relatively anemic for a while now (compared to its historic growth), it’s forecast to rise to near 7.8 MMb/d by 2035, a gain of 1.5 MMb/d.

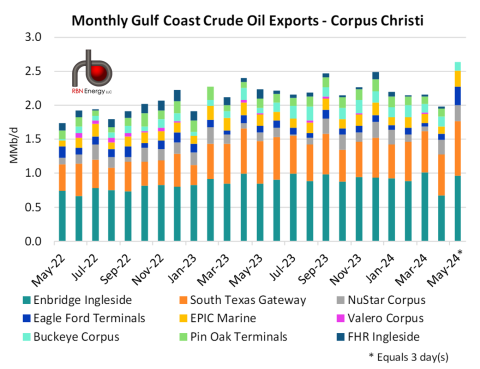

Takeaway capacity from the Permian to Corpus Christi-area refineries and its export-oriented terminals is already constrained, largely because of shipper interest in moving barrels to the two facilities in Ingleside — across the bay from Corpus proper — that can partially load VLCCs, the preferred means for transporting crude to Asia. Enbridge Ingleside Energy Center (EIEC) and Gibson Energy’s South Texas Gateway (STG) are the nation’s #1 and #3 crude export terminals by volume this year, averaging 876 Mb/d and 576 Mb/d, respectively, through the week ended May 3 (Enterprise Houston was #2 at 755 Mb/d) according to RBN’s Crude Voyager report. Each facility can fill a 2-MMbbl VLCC to about two-thirds of its capacity before sending it out to the deeper waters of the Gulf of Mexico where smaller tankers top them off with reverse lightering.

Figure 1. Corpus Christi Crude Exports by Terminal. Source: RBN’s Crude Voyager

Join Backstage Pass to Read Full Article