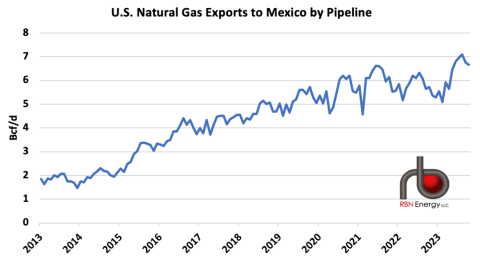

With all the talk about U.S. LNG exports and plans for more LNG export capacity, it can be easy to forget that more than 6 Bcf/d of U.S. natural gas — mostly from the Permian and the Eagle Ford — is being piped to Mexico. That’s more than 3X the volumes that were being piped south of the border 10 years ago, a tripling made possible by the buildout of new pipelines from the Agua Dulce and Waha hubs to the Rio Grande and, from there, new pipes within Mexico. And where is all that gas headed? Mostly to new gas-fired power plants and industrial facilities — a handful of new LNG export terminals being planned on that side of the border will only add to the demand. In today’s RBN blog, we discuss the ever-increasing flows of gas to Mexico and the tens of billions of dollars of new infrastructure making it all possible.

Back in 2013, in the very early days of the RBN blogosphere, we discussed what we saw as the growing gap between Mexico’s fast-growing need for natural gas and the country’s declining gas production. Man, were we onto something! Since then, Mexico’s Comisión Federal de Electricidad (CFE) has developed a massive fleet of gas-fired combined-cycle plants and helped to underwrite the buildout of a far-reaching network of gas pipelines from South Texas and West Texas into and through Mexico. Over the same 10-year period, Mexico’s gas production has declined by one-third, to about 4 Bcf/d, and only 1 Bcf/d of the gas produced there is actually sold into the domestic market — of the other 3 Bcf/d, 2 Bcf/d is used internally by Petróleos Mexicános (Pemex) for its production and refining operations and 1 Bcf/d is unusable because of its high nitrogen content (an issue also increasingly rearing its ugly head up here in the states lately — see It’s a Gas Gas Gas).

Figure 1. U.S. Natural Gas Exports to Mexico by Pipeline. Source: EIA

Join Backstage Pass to Read Full Article