US natural gas pipeline exports to Mexico increased by 45 percent in the 9 months to September 2012. This dramatic increase in flows across the US/Mexico border was caused by the need to fill a widening gap between Mexico’s dwindling supplies of gas from domestic production and higher demand for gas to generate electricity. Current low US natural gas prices have made increased pipeline imports an attractive option for Mexican State Energy Company PEMEX but not without complications. Today we take a look at Mexico’s rising gas imports from the US.

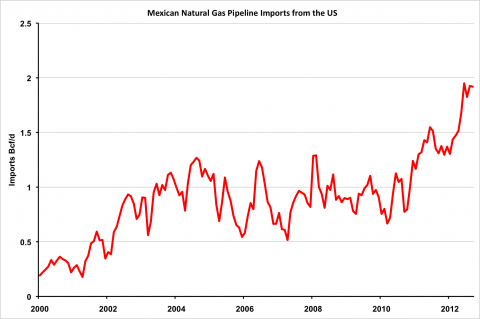

Mexico increased its imports of natural gas from the US dramatically over the past two years. The chart below shows monthly data from the Energy Information Administration (EIA) since 2000. Between 2002 and 2010 daily import volumes averaged about 1 Bcf/d. Those volumes rose by about 17 percent during 2011. Then during 2012 imports jumped another 45 percent from 1.3 Bcf/d in January to 1.9 Bcf/d in September.

Source: EIA (click to Enlarge)

Mexico’s imports increased over the past two years because the country’s demand for natural gas rose significantly while domestic production declined – requiring more imports to fill the gap. Looking at the difference between demand and local production will explain the need for increased imports. BP’s Statistical Review of World Energy (June 2012) reported Mexican demand for natural gas in 2011 as an average 6.7 Bcf/d. In 2012 demand increased to 7.8 Bcf/d according to Mexican State Oil Company PEMEX – largely driven by higher gas fired power generation burn to meet the country’s growing industrial sector’s electricity needs.

By contrast, domestic natural gas production has fallen in Mexico since 2009 and it fell again by nearly 5 percent in 2012. This declining production has come in spite of huge natural gas reserves. The US Energy Information Administration (EIA) estimates that Mexico, the world's No. 7 oil producer has 680 Tcf of natural gas including the 4th largest reserves of shale gas. (Those shale reserves include the Eagle Ford field in South Texas that extends across the border into Mexico). State owned PEMEX is simply sitting on these natural gas reserves. PEMEX has a monopoly of all Mexico’s exploration and production and has prioritized oil over gas production. PEMEX also consumes up to 40 percent of natural gas production for oil recovery in its aging heavy oil fields – effectively removing it from the market and reducing available supplies.

Join Backstage Pass to Read Full Article