Since the mid-2010s, Mexico’s Comisión Federal de Electricidad (CFE) has developed a massive fleet of natural-gas-fired combined-cycle plants and helped to underwrite the buildout of a far-reaching network of gas pipelines from South Texas and West Texas into and through much of Mexico. Now, there’s a big push to extend that network southeast through the Yucatán Peninsula to serve new power plants and industrial facilities there. The question is, with the vast majority of the pipeline capacity down Mexico’s East Coast already locked up, where will the Yucatán’s incremental gas come from? In today’s RBN blog, we discuss this potential disconnect between Mexico’s gas-related aspirations and reality.

Last month, in Down in Mexico, we discussed the steady rise in U.S. natural gas exports to Mexico and the new, south-of-the-border pipelines, power plants and industrial projects that have been making those gains possible. As we said in that blog, pipeline exports to Mexico — mostly from the Permian and Eagle Ford production areas — now top 6 Bcf/d, and still-higher export volumes are likely as new pipelines, power plants, industrial facilities and LNG export terminals come online (a subject we’ll also be covering in our upcoming webcast). We also noted that there are three primary corridors for U.S.-to-Mexico gas totaling more than 11 Bcf/d:

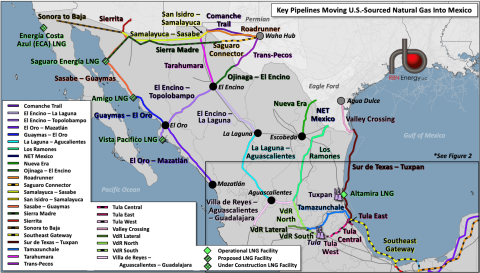

- A 3.3-Bcf/d corridor that runs west/southwest from the Waha Hub (gray dot in top-center of Figure 1) through a number of pipelines that reach into north-central, western and central Mexico.

- A nearly 1-Bcf/d pathway that runs south from the Agua Dulce Hub (gray dot in center-right) and Eagle Ford production areas to interior (i.e., non-coastal) markets in eastern Mexico.

- A 7-Bcf/d-plus corridor that also runs south from Agua Dulce, but further east. (More on this in a moment.)

Finally, we pointed out what you might call an inconvenient truth for Mexico, namely that while the country has become increasingly dependent on natural gas, its domestic production has been close to flat, with only about 1 Bcf/d of production from Petróleos Mexicanos (Pemex) — the state-owned oil and gas producer and refiner — generally sold into the Mexican market. Of the other 3 Bcf/d of Pemex gas production, about 2 Bcf/d is used internally for its production and refining operations and 1 Bcf/d is unusable because of its high nitrogen content. (That’s also an issue up here in the States lately — see It’s a Gas Gas Gas.)

Figure 1. Key Pipelines Moving U.S.-Sourced Natural Gas into Mexico. Source: RBN

Join Backstage Pass to Read Full Article