Mexico’s state-owned Comisión Federal de Electricidad (CFE) and private-sector developers of LNG export terminals have been aggressively advancing new natural gas-consuming projects in Northwest Mexico. But while plans for a number of new pipelines to help bring in gas from the Permian are on the drawing board, it remains to be seen if they can be built as quickly as they would need to be to avert a potentially ugly competition for gas supplies. In today’s RBN blog, we discuss the gas-demand and gas-delivery projects now under development in Northwest Mexico.

Over the past 10-plus years, the Mexican market has become increasingly important to U.S. producers, especially to crude oil-focused E&Ps in the Permian, whose wells also churn out vast volumes of associated gas that need to find a market. As we said a couple of months ago in Down in Mexico, Mexico’s gas production has declined by one-third since 2013, to about 4 Bcf/d, and only 1 Bcf/d of the gas produced there is actually sold into the domestic market — of the other 3 Bcf/d, 2 Bcf/d is used internally by Petróleos Mexicános (Pemex) for its production and refining operations and 1 Bcf/d is unusable because of its high nitrogen content. Over the same period, CFE has developed a massive fleet of gas-fired combined-cycle plants and helped to underwrite the buildout of a far-reaching network of gas pipelines from South Texas and West Texas into and through Mexico. The net result? Pipeline exports of U.S. natural gas now top 6 Bcf/d — 3X what they were 10 years ago.

Still, there have been hiccups in the expansion of U.S. gas exports to Mexico, in part because of occasional disconnects between the addition of incremental gas demand and the development of new pipeline capacity to deliver the needed gas. Last month, in Ahead of Ourselves?, we described the situation in Southeast Mexico, where new gas-fired power plants and industrial facilities (including Pemex’s new 340 Mb/d Dos Bocas refinery) are being developed — as are new gas pipelines to the Yucatán Peninsula. The problem is, there doesn’t appear to be enough upstream pipeline capacity in place or under development to transport sufficient volumes of gas from South Texas to those new pipes.

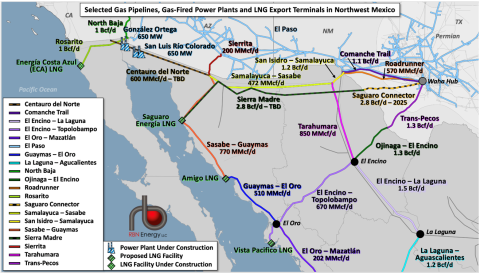

A similar scenario may be unfolding in Northwest Mexico, where new power plants have been — and will be — coming online, one LNG export facility is under construction and three others are under development. All of these will depend on U.S.-sourced gas, the vast majority of it from the Permian, but the pipeline capacity required to support that incremental demand isn’t in place, and some critically important pipeline projects face potentially serious regulatory and legal hurdles.

Figure 1. Selected Gas Pipelines, Gas-Fired Power Plants and LNG Export Terminals in Northwest Mexico. Source: RBN

Join Backstage Pass to Read Full Article