Natural gas liquids trading is quite unlike natural gas or crude oil. Natural gas is natural gas. It is a truly fungible commodity. Crude oil varies widely in quality, but it is still crude oil. Not so, NGLs. Each of the five NGLs has different physical characteristics, different end-use markets and most importantly, different factors that make prices rise and fall. It is not at all unusual for ethane prices to increase while normal butane prices fall. Or vice versa. What makes this

Daily Energy Blog

Ethanol from corn as a motor gasoline blend stock seems like a good idea. As an oxygenate it is supposed to clean up the air, and as a U.S grown renewable it reduces our dependence on fossil fuels and foreign oil. The catch is that ethanol is being mandated under a morass of mind-numbingly complex government regulations, some of which conflict with each other, or worse yet are out of step with the realities of the market. For example, the mandatory volumes of ethanol required may soon exceed the quantity that the market can use. At the same time, high corn prices have driven margins on ethanol manufacture into the red forcing many ethanol producers to shutter their operation, reducing ethanol supplies. And if that were not enough, a government program created something called the renewable identification number – RIN – a 38-digit serial number that ‘tags’ batches of renewable fuels and has resulted in all sorts of complications. Today we’ll begin an examination of the ethanol market to understand how we got in this predicament and where we go from here. In Part I we tackle one of the most intractable problems – the Blend Wall.

August natural gas closed on Friday at $3.08/MMbtu, up 8.2 cnts and above $3.00 for the first time since January 9th 2012. Crude oil was down $1.22 to $91.44/bbl. That puts the gas to crude oil ratio at 30X, about half the 54X milestone hit in April and celebrated here in the series The Golden Age Of Gas Processors. Since then gas prices are up 60% while NGLs are down 20%. April ethane production was down 4% (due to ethane rejection), and may fall another 8% by the time we see the July EIA numbers. So is the Golden Age over already? Are gas processors panhandling on the streets of South Texas – “Will Process Gas for Food”? Or are processing margins still strong enough to make the Lexus payment just not cover the Mercedes as well? To figure this out we’ll resurrect the RBN Golden Age spreadsheet and drill down into the numbers.

Three years ago the predicted onslaught of Marcellus NGL production kicked off a horse race to build new ethane pipelines out of the region. At one time, at least seven different projects were being promoted. Since then most of the projects have dropped by the wayside, yielding to Mariner West (MarkWest/Sunoco) and ATEX (Enterprise). Do those two projects provide enough capacity? Perhaps too much? What about possible competition from a new Marcellus/Utica NGL pipeline project that hit the radar screen last week? Could that be a signal that a lot more liquids are on the way?

There is a lot changing in the propane market these days. Propane prices are down hard, hit by the triple whammy of increasing production from wet shale gas, the year of no winter, and constrained Gulf Coast export dock space. Up on top of that, all the petchem crackers want ethane, leaving propane to pile up in Mont Belvieu and Conway, KS storage caverns. The problem won’t be going away anytime soon, and it won’t be limited to Belvieu and Conway. Propane production is surging in the Marcellus. With all the noise over the past couple of years about Marcellus ethane, it seems like the possibility of a significant propane surplus in the region has been under the market’s radar. But it is coming…especially in the summer when local propane demand is at a minimum. Where will the barrels go? Reportedly, one answer is being floated right now. Literally. Propane is being exported on ships from Philadelphia (Marcus Hook), bound for the Caribbean. Now that’s a development that cries out for an analysis of the fundamentals. Perhaps some on-site Caribbean research! But before we get to that, let’s examine the market conditions that are changing the landscape for propane exports so dramatically.

By 2013, nearly 300Mb/d of incremental NGL supply will flow to Mont Belvieu from the burgeoning U.S. wet gas shale plays. Belvieu continues to dominate the NGL universe because of its critical location at the center of NGL gathering systems, product distribution pipelines and the Gulf Coast petrochemical feedstock market. Is this hub big enough to handle the huge production growth? Who stands to benefit from all of the infrastructure expansion? In Part I of our series on Mont Belvieu titled Can Mont Belvieu Handle the NGL Supply Surge? we’ll examine this thing called Mont Belvieu and look at the “Big Four” Belvieu players to see how their assets dictate trading terms at the hub.

On Wednesday of last week, Conway ethane dropped to 4 cnts/gal, another multi-decade low for any natural gas liquid and an 86% decline in the ethane price since the first of the year. But Conway ethane is not the only NGL that has been suffering. As shown in the graph below, ethane propane and natural gasoline are all off hard as high propane inventories combined with a $20/bbl decline in the price of crude oil rippled through NGL markets. What do changes in the prices of these NGLs mean for the relative value of each NGL as a petrochemical feedstock? Could we see natural gasoline start competing against ethane and propane? To answer these questions and to understand how natural gasoline petrochemical feedstock economics compare to ethane and propane numbers, we’ll dive one last time into our petchem spreadsheets.

In just over a month, purity ethane prices in Mont Belvieu are off 41%, falling from 50 cnts/gal on 4/30 to 29 cnts/gal on Friday, 6/8. During the same period, non-TET propane was down 35% from 116 cnts/gal to 75 cnts/gal (see left graph, below). Last week when we looked at petrochemical feedstock economics, propane was the preferred feedstock for the first time in years. But a couple of days later that relationship flipped back to ethane. At first glance, that seems strange. Both ethane and propane increased during the first half of the week, then came back off (see right graph). But feedstock economics went from favoring propane by more than a nickel per pound of ethylene to favoring ethane by just over a penny on Friday. To understand how and why this shift happened we’ll need to break out the spreadsheets again.

EIA NGL natural gas plant production statistics were posted on Wednesday and showed something we have not seen for a few months – a decline in volume. It was not a huge decline. And with the price of Conway ethane in the dog house over the past three months, it was not unexpected. But given the importance of NGLs to both the natural gas and petrochemicals industries these days, it definitely warrants a careful examination of the numbers. We can expect to see this trend to accelerate over the next few months.

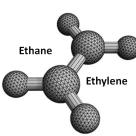

Yesterday we started our series on the economics of petrochemical feedstocks. With NGLs driving the natural gas market, it is critically important to understand the factors that influence NGL prices. The #1 factor is the petrochemical market that consumes more than half of all NGL production and 100% of the ethane. In Let’s Get Cracking we did a brief overview of olefin crackers including how they work, what they make and where they are located. We also introduced the fundamental fact of feedstock acquisition of the ethylene cracker industry: the best feedstock is the one that will produce the highest margin possible, after deducting byproduct credits. On the surface this seems simple – just make your product out of the cheapest stuff possible. But below the surface it can get quite complex. Of course, deep dives into energy analytics are what we live for here at RBN, so let’s get into the details.

Natural gas production seems totally dependent on NGLs. In turn, NGLs are highly dependent on petrochemical crackers. How does this work? What could go wrong? That’s the topic of this multi-part series on NGLs in the petrochemical industry. Part I is an overview of the market dynamics involved and will set us up for going deep into the math of petrochemical feedstocks. So let’s get cracking.

Two weeks ago we took a deep dive into the great 2012-18 ethane debate. Will we make too much of the stuff? Or not? Over the next five years, billions will be spend by the petrochemical industry chasing what promises to be huge margins for conversion of ethane to ethylene. But it will take time to bring most of that capacity online. What happens in the meantime? NGL production from wet shale plays is growing fast. If the ethane cut exceeds the ethylene industry’s capacity to consume the feedstock, then the excess ethane will be ‘rejected’ back into the natural gas stream. When and if this happens, the price of ethane in Mont Belvieu will drop to something near fuel value at the gas processing plant. The debate is whether or not this is likely to happen.

Last Thursday we looked at one side of the great 2012-18 ethane debate. Will we make too much of the stuff? Or not? Will the petrochemical industry have the capacity to chew up rapidly increasing ethane production. Or could producers and processors churn out so much ethane that the price will be forced down to fuel value (a price equivalent too natural gas), resulting in massive ethane rejection at gas processing plants.

This is how midstreamers at the Platts conference talk about the Eagle Ford? Sounds more like a description of my wife’s Havanese after a bath than a description than one of the most prolific NGL plays on the continent. But these weren’t really complaints. It was just midstreamers pointing out some of the challenges of life in the Eagle Ford NGL business, circa 2012. And of course, these are certainly white collar problems. This is another blog based on presentations at the Platts Midstream conference. Today we’ll look at each of the three issues from the title and pick a couple of examples of solutions and strategies being used by players in the South Texas area.

For the past two days I’ve attended the 5th Annual Platts Midstream Development Conference at the JW Marriott in Houston. After a while you start to get a little tired of phrases like ‘astronomical growth’, ‘unprecedented opportunities’, and ‘game changing technology’. There was a steady stream of midstream investment projects in every sector of the oil, gas and NGL markets in the U.S. And there were few disagreements about the trajectory of production or the need for new infrastructure to get the production to market. That is, except for one issue. And that issue was ethane. As documented here on several occasions (most recently this week in Monitor Monitor and Rock Bottom), ethane production has increased dramatically over the past year and today ethane prices in both Conway and Mont Belvieu are depressed (yesterday 43.4cnts/gal for MB purity and 12.4cnts/gal for Conway E-P). But the real question is the next five to six years. Will petrochemical producers add enough ethane capacity each year to absorb the expected growth in ethane production, or will producers outrun the petchems and drive prices to fuel value for an extended period of time?