There is a lot changing in the propane market these days. Propane prices are down hard, hit by the triple whammy of increasing production from wet shale gas, the year of no winter, and constrained Gulf Coast export dock space. Up on top of that, all the petchem crackers want ethane, leaving propane to pile up in Mont Belvieu and Conway, KS storage caverns. The problem won’t be going away anytime soon, and it won’t be limited to Belvieu and Conway. Propane production is surging in the Marcellus. With all the noise over the past couple of years about Marcellus ethane, it seems like the possibility of a significant propane surplus in the region has been under the market’s radar. But it is coming…especially in the summer when local propane demand is at a minimum. Where will the barrels go? Reportedly, one answer is being floated right now. Literally. Propane is being exported on ships from Philadelphia (Marcus Hook), bound for the Caribbean. Now that’s a development that cries out for an analysis of the fundamentals. Perhaps some on-site Caribbean research! But before we get to that, let’s examine the market conditions that are changing the landscape for propane exports so dramatically.

Check out Kyle Cooper’s weekly view of natural gas markets at http://www.rbnenergy.com/markets/kyle-cooper |

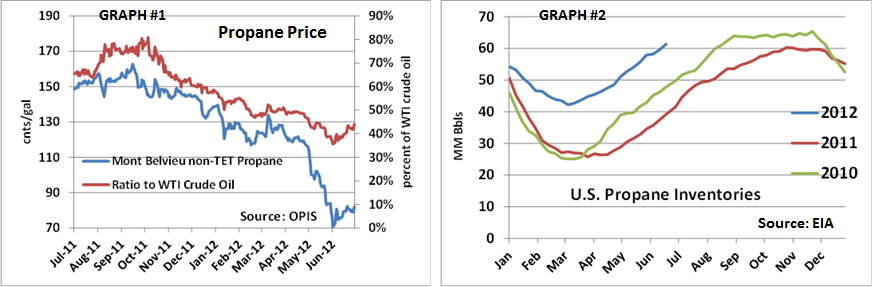

First, we’ll examine what has happened to propane over the past twelve months. As shown in Graph#1 below, at this time last year the price of Mont Belvieu non-TET propane was in the 150 cnts/gallon range, at a healthy 60-80% ratio to the price of WTI. To some extent, propane tracks crude prices (for the reasons explained in Let’s Get Crackin – Part IV, and other blogs in that series) and a 60-70% relationship to crude oil is pretty typical from a long term perspective. But sometime around December 2011, that relationship started to break down. Over the next six months, the price of propane relative to crude dropped to 35% before rebounding slightly over the past few weeks. Most of the decline in propane prices from the 150 cnts/gallon range down to 120 cnts/gallon can be attributed to a decline in the value of propane relative to crude oil – and that was due to increasing supplies from shale, low demand due to the warm winter and constraints on Gulf Coast export capacity. The result was the inventory growth shown in Graph #2. As indicated, propane inventories this year are up more than 50% over 2011; about 30% over 2010.

Then in early May after months of relative stability around $100/bbl, crude oil prices headed south. The ratio of propane to crude remained steady. But the decline in crude prices dragged propane down with it. And that’s what gave us the 70-80 cnt/gallon propane prices we see in the market today.

Join Backstage Pass to Read Full Article