The Biden administration has placed some big bets on clean hydrogen, seeing it as a replacement fuel for some hard-to-abate industries and putting it at the heart of its long-term decarbonization efforts. But while clean hydrogen has significant long-term potential — backed by major subsidies, including the 45V production tax credit (PTC) — figuring out a path to a greater role in the U.S. energy mix is more complicated than it might seem. The proposed rules around the tax credit have stirred up a hornet’s nest worth of criticism from those who think the guidance might ultimately do more harm than good. In today’s RBN blog, we’ll preview our latest Drill Down Report on the incentives — primarily the 45V tax credit — intended to expand the clean hydrogen industry and examine some of the barriers to significant growth.

Development of a clean-energy economy was a key plank in President Biden’s campaign platform four years ago and it has remained a priority since he took office in January 2021. With a focus on the short-term changes necessary to make any long-term goals viable, Biden set out some ambitious 2030 targets: at least 80% of U.S. power generated by renewable sources, a 50%-52% reduction (from 2005 levels) in greenhouse gas (GHG) emissions, and production of 10 million metric tons per annum (MMtpa) of clean hydrogen (ramping up to 20 MMtpa by 2040 and 50 MMtpa by 2050).

The administration was able to steer passage of two important pieces of legislation in its first two years: the Infrastructure Investment and Jobs Act (IIJA, better known as the Bipartisan Infrastructure Law) was passed in November 2021 and the Inflation Reduction Act (IRA) became law in August 2022. Among other things, the IIJA established $8 billion in federal funding for the development of a clean-hydrogen industry, including $7 billion for a series of regional hubs (see The Contenders for more) to be developed across the country. The IRA, widely seen as a game-changer regarding incentives around clean energy, includes provisions on everything from methane emissions and electric vehicles (EVs) to carbon capture and sequestration (CCS) and alternative fuels, but one of the most significant elements was the inclusion of the 45V tax credit.

Passage of the IRA set off intense debate (and lobbying) about how the guidelines around the 45V tax credit would be written and implemented. While some industry groups argued for looser guidelines around the PTC that would allow the clean hydrogen industry to grow quickly, others called for a stricter set of rules from the start, arguing that an approach that was too lax would fail in the ultimate goal to substantially decrease GHG emissions. Those guidelines were widely expected to be announced by August 2023, but as summer turned into fall, and fall into winter, it was clear that the debates over 45V were continuing inside the Biden administration. The rules were finally rolled out in December. Publication of the proposed rulemaking began a 60-day comment period, which concluded February 26.

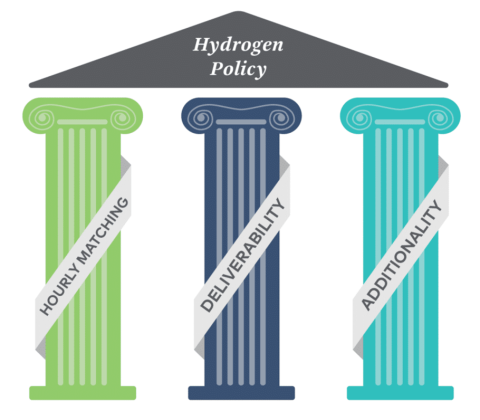

Figure 1. The “Three Pillars” of Clean Hydrogen Production. Source: 3Degrees

Join Backstage Pass to Read Full Article