The Biden administration has placed some big bets on clean hydrogen, seeing it as a replacement fuel for some hard-to-abate industries and putting it at the heart of its long-term decarbonization efforts. All of these bets are backed by a brand-new tax credit. But the goal isn’t just to drive production of more hydrogen — it’s also to make hydrogen in a specific way, with measurable decreases in greenhouse gas (GHG) emissions. That means producing hydrogen that qualifies for the tax credit is going to be a lot easier said than done. The proposed rules include a concept called deliverability — one of the “three pillars” of clean hydrogen — that adds further challenges to producers hoping to cash in on the tax credit and puts into further peril any number of potential projects. In today’s RBN blog, we’ll explain how deliverability works, how it fits into the proposed rules, and the challenges it will pose for hydrogen producers and power generators alike.

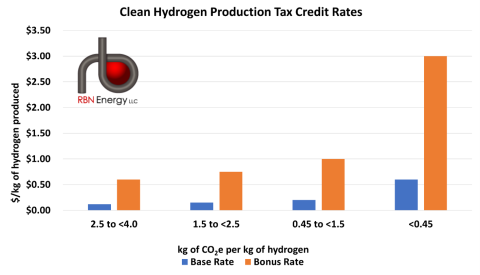

A frequent topic of debate — and fierce lobbying — following passage of the Inflation Reduction Act (IRA) in August 2022, the proposed rules around the federal government’s Hydrogen Production Tax Credit (PTC), also known as 45V, were rolled out in late December 2023. Under 45V, credits of up to $3/kilogram (kg) are available based on the rate of lifecycle GHG emissions during a clean hydrogen facility’s first 10 years of operation. As defined by the IRA, clean hydrogen is produced in a way that results in a lifecycle GHG emissions rate of not more than 4 kg of carbon dioxide (CO2) equivalent per kilogram of hydrogen (CO2e/kg). As we described in Part 1 of this series, that new standard could severely limit how much of the tax credit is available to many of the potential low-carbon hydrogen production facilities. For example, a blue hydrogen project — one in which hydrogen is produced through the auto thermal reforming (ATR) or steam methane reforming (SMR) of natural gas, with the resulting emissions mitigated by carbon capture — can qualify for the credit if it has sufficiently high carbon-capture rates, but the proposed regulations likely limit it to the bottom two tiers of the credit (two pairs of blue and orange bars to left in Figure 1) due to a “locked” upstream natural gas feedstock emissions factor. As you can see, there are four tiers to the credit, based on the lifecycle GHG emissions rate, and the credit is far less generous for production that falls into the bottom three tiers (three blue and orange pairs to left) than the highest tier (blue and orange pair to far right).

Figure 1. Breakdown of 45V Tax Credit. Source: Treasury Department

Note: The PTC includes a base rate (blue bars) and a bonus rate (orange bars), which is 5X the base rate and is for producers that meet prevailing wage and apprenticeship requirements.

Join Backstage Pass to Read Full Article