If you’re vying for billions in federal dollars, a predictable selection process with measurable criteria is probably what you’re hoping to see. And while there was much speculation about what projects would be ultimately picked for the Department of Energy’s (DOE) regional clean hydrogen hubs initiative, H2Hubs, the selections made October 13 included no curve balls and matched the agency’s previous guidance. In today’s RBN blog, we’ll look at the selections and how they fit into the DOE’s stated criteria.

We’ve been following the discussions about hydrogen hubs since the DOE announced details around the hub initiative in a Funding Opportunity Announcement (FOA) published in September 2022 that defined a hub as “a network of clean hydrogen producers, potential clean hydrogen consumers, and connective infrastructure located in close proximity.” The FOA set out the overall goals of the program: the creation of six to 10 regional hubs that would receive up to $7 billion in federal funding to help meet the Biden administration’s targets of producing 10 million metric tons per annum (MMtpa) of clean hydrogen by 2030, 20 MMtpa by 2040, and 50 MMtpa by 2050.

Money for the hydrogen hubs was included in 2021’s Infrastructure, Investment and Jobs Act (IIJA), better known as the Bipartisan Infrastructure Law. Projects interested in receiving those federal dollars had to first submit a concept paper about their proposal, which was due in November 2022. Of the 79 projects to submit a concept paper, 33 received formal encouragement from the DOE in late 2022 to submit a full application by April 7, 2023. Each paper’s assessment was based on evaluation criteria that included qualifications, experience and capabilities; expected contributions toward a national hydrogen network; plans to develop production, end-use, and connective facilities; and community benefits. The full list of encouraged projects wasn’t released, but we were able to identify all of them in September. (We’re also pursuing the list of projects that submitted a full application to the DOE. When we get it, we’ll discuss it in our weekly Hydrogen Billboard.)

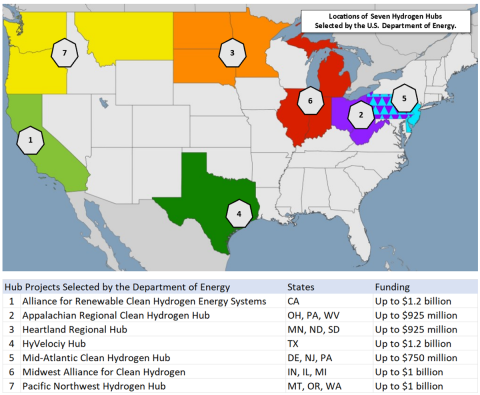

News about the hydrogen hubs has been pretty quiet since summertime, with few hints about when the DOE might make its decision on the hubs or which ones stood the best chance of selection, aside from our own analysis about which projects appeared to be the strongest. (The same quiet can be said of rules around the new tax credit for clean hydrogen. More on that in a bit.) To our thinking, hub projects that could contribute to a national network and produce hydrogen on a commercial scale; incorporate upstream, midstream and downstream considerations; and embrace environmental justice initiatives were likely to have the best odds. The DOE made its hydrogen hub selections on October 13, picking seven proposals with a variety of strategies and located across the U.S. Let’s look at how those picks match up with two key elements of the DOE’s criteria: feedstock diversity and end-use diversity.

The DOE said in its guidance that at least one hub will use natural gas to make clean hydrogen, another will use renewable power, while another will use nuclear power. Natural gas is the centerpiece of the Appalachian Regional Clean Hydrogen Hub (ARCH2; #2 and purple states in Figure 1 below), a collaborative involving more than 40 entities and which can leverage the region’s ample access to low-cost natural gas to produce clean hydrogen and permanently store most of the associated carbon emissions. The location of the hub and development of hydrogen pipelines, multiple hydrogen fueling stations, and permanent carbon dioxide (CO2) storage is designed to drive down the cost of hydrogen distribution and storage. (States included: Ohio, Pennsylvania, West Virginia. DOE support: Up to $925 million. Prime contractor: Batelle.)

Figure 1. Locations of U.S. Hydrogen Hubs. Source: Department of Energy

Note: Pennsylvania is shaded in purple and light blue because it is a part of two hub projects.

Join Backstage Pass to Read Full Article