The U.S. may be in a monthslong pause in approving new LNG exports but that doesn’t change the fact that U.S. LNG export capacity will nearly double over the next four years, that most of the new liquefaction plants are being built along the Texas coast, and that their primary source of natural gas will be the Permian Basin. That helps to explain why three big midstream players — WhiteWater/I Squared, MPLX and Enbridge — recently formed a joint venture (JV) to develop, build, own and operate gas pipeline and storage assets that link the Permian to existing and planned LNG export terminals. In today’s RBN blog, we examine the new JV and discuss the ongoing development of midstream networks for crude oil, natural gas and NGLs.

The Biden administration’s announcement in late January that the Department of Energy (DOE) would be taking ”a temporary pause” on pending decisions on exports of LNG to non-Free Trade Agreement (FTA) countries cast a dark cloud over what has become a blockbuster business — namely, liquefying many billions of cubic feet of natural gas every day and shipping that LNG to Europe, Asia and other global markets. But while the pause is likely to set back a few LNG export projects and may derail others, a number of projects that already have their needed approvals from the DOE (and the Federal Energy Regulatory Commission, or FERC) in hand are advancing toward commissioning and full operation over the next one to four years. Together, they are expected to increase U.S. LNG export capacity to about 25 Bcf/d from the current 14 Bcf/d.

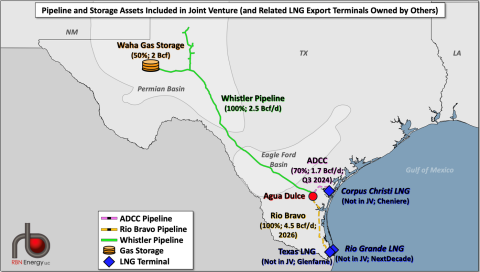

Of that 11 Bcf/d of incremental capacity, more than 8 Bcf/d will be sited along the Texas coast. These projects include Cheniere Energy’s 1.4-Bcf/d Stage III at Corpus Christi LNG, which is scheduled to begin starting up late this year; QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG in Sabine Pass, TX, which will start coming online in the first half of 2025; NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG in Brownsville, starting up in 2027; and Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG, coming online in 2027-28. While each of these liquefaction/LNG export facilities will receive feedgas from multiple sources, the Permian, with its vast supplies of associated gas and extensive pipeline connections to Gulf Coast markets, will be a primary source for each of them — especially Corpus Christi LNG and Rio Grande LNG, which have (or will have) the most direct pipeline links from the Permian. Also, Glenfarne Energy Transition hopes to make a final investment decision (FID) on its planned 500-MMcf/d Texas LNG project (also in Brownsville) later this year and to begin commercial operation of the facility as soon as 2028-29.

With the gas supply needs of these projects top of mind, WhiteWater/I Squared, MPLX and Enbridge on March 26 announced plans for a JV to develop, build, own and operate gas pipeline and storage assets connecting Permian supply to LNG export terminals and other Gulf Coast and south-of-the-border demand. WhiteWater/I Squared will hold a 50.6% stake in the JV to be formally created later in Q2 2024, while MPLX, a master limited partnership (MLP) formed by Marathon Petroleum, will own 30.4%, and Enbridge will own 19%.

Figure 1. Gas Pipeline and Storage Assets Included in Joint Venture. Source: RBN

Join Backstage Pass to Read Full Article