Over the past week (Jan 13-20, 2013) the ethane-to-gas ratio has recovered slightly from 0.99 to 1.05, mostly due to a 3 cnt/gal increase in the price of purity ethane at Mont Belvieu (OPIS 24.5 cnts/gal). [See today’s Spotcheck “Ethane to Henry Hub Gas Ratio” graph. Click here if you have trouble accessing Spotcheck.] But that does not change the fact that the ethane market is still deep in ethane rejection territory. What does it mean for gas processing economics? And how do different gas streams impact NGL recoveries, ethane rejection and tailgate gas volumes. That’s what we’ll examine today.

In the last blog of this series titled Inside the Ethane Asylum – Gas Processing Economics – Part 4, we did a deep dive into the RBN Gas Processing model’s residue gas calculation, showing for a representative Eagle Ford plant [1] how the volume and BTU content of a plant tailgate stream is calculated. Combining this with the inlet stream and NGL calculations in Part 3 we were able to demonstrate that the plant calculations balanced to zero [2], proving that the total energy content of what goes into the plant equals the energy content that comes out of the plant. As we have described repeatedly, the model we are using is based on something we call MQQV, a totally non-memorable RBN coined acronym meaning Measurement, Quantity, Quality, and Value. By the end of Part 4 we made it through Measurement, Quantity and Quality. Today we get to the final piece of that equation – Value.

Check out Kyle Cooper’s weekly view of natural gas markets at http://www.rbnenergy.com/markets/kyle-cooper |

But before we jump again into the modeling morass, we would be irresponsible if we didn’t mention that: (a) this is a deep dive, not a casual read; (b) it will be difficult if not impossible to follow today’s discussion without having read Parts 1, Part 2 and the other two parts referenced above, and (c) to really follow the math you need to download the attached spreadsheet and follow along. We’ll be referring back to column and row numbers identified in the spreadsheet and used in the calculation descriptions for Table#1, Table#2 and Table#3 in previous parts of the series. The spreadsheet download link is at the bottom of this blog. If you have trouble with the download, please email info@rbnenergy.com and we’ll send you a copy.

Value - Table#4

Value is the economic uplift provided by NGL extraction at the plant – basically adding prices to our model to value the inlet and outlet streams. Note that we don’t call it plant gross margin. That is because the plant does not keep all of the economic uplift. It is shared on some basis with the producer. In fact it is the contracts between the owner/operator of the plant and the producers providing inlet gas to the plant that determines how much of the value goes back to the producer, and how much of the value stays with the plant. We went through the three main types of gas processing contracts – fee, keep-whole and percent-of-proceeds (and who keeps the value from each) in The Golden Age of Natural Gas Processors – Part IV. So what we are calculating in this model is the total value uplift, shared in some way between the producer and plant operator.

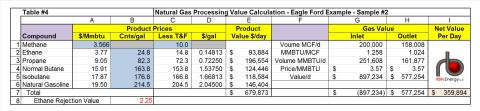

Fortunately, compared to some of the other calculations we’ve been through, the math for computing value is relatively simple. The calculations are shown below in Table#4. Continuing with the same convention we used in Part 4, our input variables are the cells in Blue, the columns are labeled with letters A through I, and the rows with numbers 1 through 7. We will refer to rows, columns and cells using Excel-like nomenclature.

For our calculations today we’ll use market prices as of Friday, January 18th. For natural gas (methane) the price is the CME/NYMEX prompt month natural gas futures closing price [3]. That number is in Cell A1. For NGLs, the prices are OPIS non-TET prices in Mont Belvieu. Those numbers are in cells B2…B6.

Using the BTU/Gallon factors in Column (b) of the Standard Factors (Table #1) we calculated the price per MMBtu of each of the NGLs in Cells A2…A6. We don’t need these numbers in the model but they show the relative value of the liquids outputs and help explain how the plant economics work as we go though the calculations. For example ethane is priced only slightly more than natural gas on a BTU basis (it was below natural gas last week) but natural gasoline is more than 5X the price of natural gas and adds huge value uplift to the plant.

Our only other input variable is the assumed transportation and fractionation (T&F) cost number of 10 cnts/gall in Cell C1. This is the cost of transporting by pipeline the mixed NGL tailgate volume (Y-grade) from the plant to a fractionator in Mont Belvieu (since our prices are Mont Belvieu prices) and then splitting the Y-Grade into the five purity NGL products. Of course, costs for transportation vary greatly depending on the location of the plant and costs for fractionation varies with the fractionation contract arrangements for the barrels. Ten cents is a reasonable number for a typical plant feeding the Mont Belvieu fractionation complex. We deduct T&F from the price and divide by 100 to get the prices into dollars per gallon for the rest of our calculations.

Note the number in Cell B1. We calculated this number to show the value of ethane at the plant on a BTU basis – so this number is calculated just like the number in Cell A2, except that the 10 cnts/gal was deducted before converting to BTUs. This demonstrates that the price of ethane at the plant is $2.25/MMbtu, about $1.32/MMbtu below the price of natural gas and thus indicates that ethane rejection economics are superior to ethane extraction economics.

Product value per day in Column (E) is simply the price in $/gal in Column (D) times Liquids production in Column (E) of Table #2. (To see Table#2 you must go back to Part 4 of this series or look at the attached downloadable spreadsheet.) Note that ethane only contributes $93,884/day of that product value while natural gasoline contributes $146,893/day. In fact, ethane is only contributing 14% of the total product value uplift of $679,873/day in Column (E). All the rest of the value is coming from the other products.

In the next part of Table#4 (Columns F–H) we calculate the value of the gas coming into the plant and the value of the gas leaving the plant. On the inlet gas side the total volume in Cell G1 comes from Cell D9 in Table#2 and the BTU content of the stream in Cell G2 comes from Cell H8 in Table #2. Multiplying those two numbers together gives us 251,608 in Cell G3 – the inlet volume of the plant in MMBtu/day. Multiplying that volume by the $3.566/MMbtu price of natural gas yields the theoretical value of the inlet gas stream of $897,234 in Cell G4. Note the word theoretical. That is because natural gas with a BTU content of 1,258 would not be accepted by a gas pipeline due to high BTU content and other spec problems, and therefore could not really be sold at a price of $3.566/MMbtu. Don’t lose a lot of sleep over this fact. All we are saying is that the inlet stream is being valued at natural gas prices, not that the inlet stream would ever be sold in its entirety as natural gas. [We’ll talk more about “must process gas” and how that relates to the value equation between producers and gas plant operators in a later blog.]

Column (H) goes through the same calculation for the Outlet, or Tailgate gas stream. The Volume in Cell H1 comes from Table#3, Cell J7. The BTU content in Cell H2 comes from Table#3, Cell M7. Multiply those two numbers together and we get 161,877 – the outlet volume of the plant measured in MMBtu/day. Multiply that price times the $3.566/MMbtu price of natural gas to yield the theoretical value of the tailgate gas stream of $577,254/day in Cell H7.

The last step is to take the total value of the NGLs that the plant produced of $679,873/day (Cell E7) plus the value of the outlet gas stream of $577,254/day in Cell H7. That gives us a total plant output value of $1,257,126/day less the value of the inlet gas of $897,234/day (Cell G7) to equal $359,894/day. That’s our answer in Cell I7. This plant throws off $360,000 per day of value. Not bad for a world of low NGL prices.

Ethane Rejection

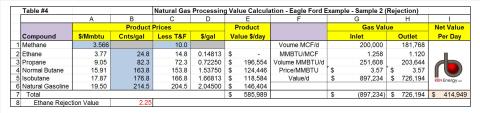

Now that we have the model built, running cases for other gas plant configurations and inlet gas streams is fast and easy. As noted above, the plant would want to reject ethane because the price of ethane is $1.32/MMbtu below the price of natural gas after deducting the 10 cnt/gal T&F cost from the price of ethane.

To run the ethane rejection case for our current plant sample, just reduce the estimated recovery percentage for ethane from 90% to 0% in Cell D2 of Table#2. (This case is in the 2nd tab of the download spreadsheet). The resultant Table#4 follows.

Note the key changes. First, profitability is up from about $360k to about $415k. That is because the ethane rejected is worth more as gas than it is as ethane. Of course, that is the reason why the plant went into rejection in the first place. Second, you can’t see it on this Table, but if you compare the NGL production in the two cases, total production in the ethane rejection case is down by 15,091 Bbl/day, the volume of ethane in the recovery case. That means that 55% of the NGL volumetric output is gone in the rejection case. Poof. But product revenue is up while NGL volume is down. It doesn’t seem right unless you look at the heat content volume of the outlet stream (Table #3 Cell Q3), which increases from 161,887 MMbtu/d to 203,644 MMbtu/d, or an increase of 41,767 MMbtu/d. At a gas price of $3.57/MMbtu that generates more revenue that was lost from the lower NGL production. And that’s what ethane rejection is all about.

Almost all, that is. That extra 41,767 MMbtu/d of natural gas doesn’t just disappear, it moves straight into the natural gas marketplace, increasing already bloated supplies. That additional gas must be transported to market in sometimes constrained pipelines, and it must be delivered into market hubs that are already dealing with the curse of overproduction. Hence our title, Tailgate Blues. For our sample plant, it’s a 26% increase in the tailgate BTU quantity. Fortunately for natural gas bulls, our plant is not representative of the impact over the entire market. We’ll address that question in greater detail in a follow on blog later this week.

The Other Eagle Ford Samples

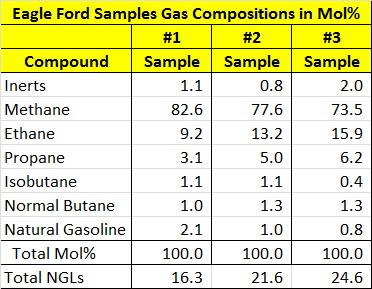

Continuing with our individual plant analysis, we promised weeks ago to show the impact on our model of using 3 Eagle Ford gas samples that have different liquids levels (called Samples #1, #2 and #3). So far all of our calculations have been with sample #2. The three samples we started with are shown in the table below (numbers rounded to one decimal). Our source for these samples is shown in Part 3.

To see the results for Sample #1 and Sample #3, just select the relevant tabs on the download spreadsheet – remember Sample #2 is the first tab on the sheet. We start here with Sample #1 – that is leaner than Sample #2. This is certainly not lean gas by any stretch, but it is on the lean side for liquids rich Eagle Ford production. The calculated inlet stream BTU (Table #4 Cell G2 in the model) for Sample #1 drops from 1,258 to 1,220. That cuts liquids production by nearly 6 Mb/d or 22%. But net value per day increases! By nearly $75k/day. Why? Because the percent ethane is down to 50% while the percent of natural gasoline is up to 17%. Look at the Mole% numbers in the samples table above . Twice as much natural gasoline makes all the difference in the world. Because that’s the product that sells for 5X the price of natural gas. A small change in the percentage of the natural gasoline component at our sample natural gas plant makes a big difference to value uplift. Underline that a few times. We are not going to show all the tables for these cases. The numbers are all in the downloadable spreadsheet.

Sample #3 is richer than #1, but has less natural gasoline. When the Sample #3 mole % numbers are input into the Model, they yield 60% ethane and only 4% natural gasoline at the outlet of the plant. NGL production is up by about 3 MB/d, but net value per day is down by about $72k/day. That’s because the plant makes more ethane, less gasoline. And the plant should be in rejection. If we put the plant into rejection, net value recovers by $66k/day due to the plant selling more ethane at the higher price that it gets for natural gas. Again, look at the cases in the spreadsheet.

Hacking a Model of the U.S. Market

That’s all well and good you say, but that still doesn’t tell us what ethane rejection means to the market as a whole. Nay, nay grasshopper. But what is the U.S. market for natural gas processing but an aggregation of all U.S. processing plants? And lo, we can know the aggregated input variables for our model - inlet gas, NGL production by component, etc. from our Federal Government in the form of EIA statistics. So that means we can hack this model up to represent the entire market. Later this week we will do just that to represent the U.S. gas processing market and gain important insights about what ethane rejection means for NGL and natural gas supplies.

Tailgate Blues by Luke Brian is the title track from the album Tailgates and Tanlines released on August 9, 2011. See, we really do listen to music other than golden oldies.

|

Each business day RBN Energy releases the Daily Energy Post covering some aspect of energy market dynamics. Receive the morning RBN Energy email by signing up for the RBN Energy Network. |

[1] A RBN member pointed out this week that we had a typo in in Part 3 when we showed the Mole% numbers for our three Eagle Ford samples. That typo has been fixed.

[2] Early on in this exercise we warned that a great many simplifying assumptions were inherent in this model, otherwise we could never get though it in a daily blog. As several of our Members pointed out, one important assumption that we failed to mention is that this model assumes that fuel and loss across the plant is zero. In the real world, that is not the case. In processing plants, some of the inlet gas stream is used in the extraction process for fuel and a small percentage of the gas ‘disappears’ due to measurement error and other factors. If fuel and loss are calculated, they can be treated as a factor in the balance, but those computations are beyond our scope here.

[3] The Henry Hub price could and should be adjusted for basis differentials and transportation costs to the plant tailgate. We’ve simplified this calculation away for our model because it is essentially irrelevant to our conclusions.

Comments

Tailgate Blues

I checked the EIA for NGL production by basin by product and they only report aggregate NGL production--it is not broken out by product (ethane, propane, butanes, etc.). Am I missing something? If there is such information do you have a link to the site? Thanks!