Crude oil production in the Permian may or may not have peaked — that’s TBD. What we do know is that even if the shale play’s oil output flatlines, the Permian will generate increasing volumes of natural gas (and NGLs) and virtually all of it will need to be piped to other markets, primarily the Gulf Coast to feed existing and planned LNG export terminals, gas-fired power plants and other large consumers. To keep pace with that undeniable need for more Permian-to-Gulf takeaway capacity, WhiteWater has announced plans, through its Matterhorn joint venture (JV), for yet another mountain-themed gas conduit to the coast. In today’s RBN blog, we discuss WhiteWater’s newly unveiled Eiger Express Pipeline.

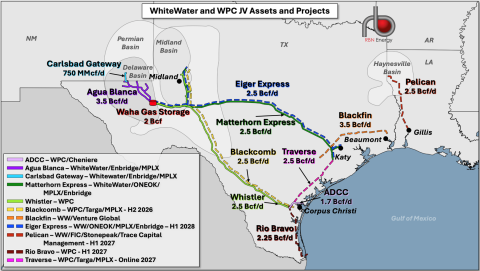

WhiteWater, with financial backing from I Squared Capital and FIC Partners Management, is a midstream powerhouse in Texas. It has developed a number of critically important gas pipelines, typically via JVs with other large midstreamers — a prime example being the 2.5-Bcf/d Matterhorn Express Pipeline, which is co-owned by WhiteWater (65%), ONEOK (15%), MPLX (10%) and Enbridge (10%). WhiteWater announced on August 25 that the company and its Matterhorn partners have made a final investment decision (FID) to build the 42-inch-diameter Eiger Express Pipeline (dashed dark-blue line in Figure 1 below). Eiger Express is 70% owned by the Matterhorn JV, with MPLX and ONEOK each holding 15% stakes incremental to their interests in the JV.

Like Matterhorn Express (dark-green line), the new pipe will run from the Waha Hub in Pecos County, TX, to the Katy area west of Houston. It also will connect to the planned Traverse Pipeline (dashed magenta line) in Wharton County, TX. Supply for Eiger Express will be sourced from multiple connections in the Permian, including gas processing facilities in the Midland Basin, and from the Delaware Basin via the Agua Blanca Pipeline, a JV between WhiteWater, Enbridge and MPLX. (More on Agua Blanca later.)

Figure 1. Eiger Express Pipeline and Other WhiteWater Assets and Projects. Source: RBN

The 2.5-Bcf/d Eiger Express Pipeline is named after an iconic, 13,105-foot peak in the Swiss Alps (see photo below). the Eiger mountain, along with the Matterhorn and Mont Blanc, are considered among the Alpine range’s “Big 3” climbing challenges. With WhiteWater’s propensity to name their pipelines after mountains, we wouldn’t be surprised to see a Mont Blanc Pipeline project in the not-too-distant future.

Eiger’s North Face. Source: Wikipedia

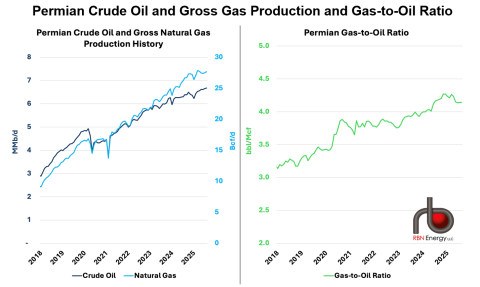

The pipeline itself is slated to begin commercial operation in the first half of 2028. Given the Permian’s frequently constrained natural gas landscape and rapidly rising gas-to-oil ratio (GOR; see Figure 2 below), the RBN Arrow Model anticipates that a new pipeline will be needed to provide incremental capacity and that the Permian-to-Katy corridor would be the most logical place for it to be developed. (More on that in a moment.)

Figure 2. Permian Crude Oil and Gross Gas Production and Gas-to-Oil Ratio. Sources: Enverus, RBN

WhiteWater’s Other Assets and Projects

WhiteWater is, as we said, a top-tier midstream player in the region, and laser-focused on natural gas. It operates and holds ownership interests in a growing number of gas pipelines and other assets in Texas, New Mexico and Louisiana, including Whistler Pipeline (light-green line in Figure 1). Whistler, named after a snow-capped mountain and ski resort in British Columbia, came online as a 2-Bcf/d facility in July 2021; its capacity was expanded to 2.5 Bcf/d in September 2023.

(Very importantly, the Whistler Blackcomb ski resort is home to two of RBN’s favorite runs: Rock ‘n’ Roll and Backstage Pass. Coincidence? We think not!)

Well-Named Slopes at the Whistler Blackcomb Ski Resort in British Columbia.

Source: RBN’s Noel Copeland

The Whistler Pipeline is one of several existing and planned pipelines that are now fully or partly owned by a WhiteWater-led JV with MPLX and Enbridge announced in March 2024. The JV itself — formally known as Whistler Pipeline LLC, or WPC — is 50.6% owned by WhiteWater, with MPLX holding a 30.4% stake and Enbridge owning the remaining 19%. (I Squared Capital owns WhiteWater’s stake in WPC.)

In addition to owning 100% of the Whistler Pipeline, the WhiteWater/MPLX/Enbridge JV owns:

- A 70% stake in the 43-mile, 1.7-Bcf/d ADCC Pipeline (light-purple line) from Agua Dulce to Cheniere Energy’s Corpus Christi LNG export terminal, with Cheniere owning the other 30%.

- A 70% stake in the planned 2.5-Bcf/d Blackcomb Pipeline (dashed yellow line) from the Permian to Agua Dulce that is being installed alongside the JV's Whistler Pipeline and will enter service in H2 2026. Targa Resources holds a 17.5% interest in the project and MPLX holds a 12.5% stake, in addition to being part of the WPC JV.

- A 70% stake in the recently upsized 2.5-Bcf/d Traverse Pipeline (dashed magenta line), a planned bidirectional gas line that by 2027 will run 160 miles between Agua Dulce and the Katy area west of Houston. As with Blackcomb, Targa holds a 17.5% interest in Traverse and MPLX a 12.5% stake, again beyond its interest in WPC. (See Any Way You Want It for more).

- All of the planned 2.25-Bcf/d Rio Bravo Pipeline (dashed dark-red line) from Agua Dulce to the planned Rio Grande LNG export terminal in Brownsville, TX. Rio Bravo is slated to come online in H1 2027. (Enbridge contributed its once fully owned Rio Bravo project to the WhiteWater JV as part of that deal.)

- A 50% ownership interest in the 2-Bcf/d Waha Gas Storage facility (red tank icon).

Separately — and as we noted earlier — WhiteWater also holds a 65% ownership interest in the 490-mile, 2.5-Bcf/d Matterhorn Express pipeline from Waha to the Katy area. The pipeline, which came online in October 2024 and has a lateral that extends into the Midland Basin, is co-owned by ONEOK (with a 15% stake), MPLX (10%) and Enbridge (10%).

In addition, WhiteWater holds a 75% stake in the Agua Blanca Pipeline (dark-purple line), a 200-mile, 3-Bcf/d system that delivers gas from processing plants in the Delaware Basin to Waha. The pipeline is co-owned by Enbridge (15%) and MPLX (10%). The three companies also share ownership of the 400-MMcf/d Carlsbad Gateway gas pipeline system (light-blue line) in the Delaware, which feeds residue gas into Agua Blanca.

WhiteWater also holds a 50% stake in the planned 193-mile Blackfin Pipeline (dashed orange line), which will run from Colorado County, TX, to Jasper County, TX, and have the capacity to transport up to 3.5 Bcf/d. The pipeline is co-owned by Venture Global (50%).

Finally, WhiteWater is leading the development of the 170-mile Pelican Pipeline (dashed red line) from Williams, LA, to the Gillis, LA, gas hub, which was recently upsized to a 42-inch-diameter pipe and a capacity of 2.5 Bcf/d (from the original 36-inch pipe and 1.75 Bcf/d). WhiteWater is partnering with private-equity firms FIC, Stonepeak and Trace Capital Management on the project, which is slated to come online in Q2 2027.

The Eiger Express Pipeline and RBN’s Arrow Model

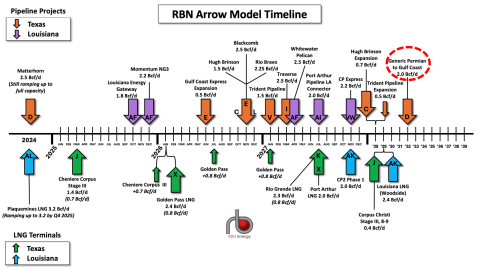

As we hinted at earlier, WhiteWater’s newly announced Eiger Express Pipeline, with its mid-2028 online date, gets a jump on what the RBN Arrow Model anticipates will be a need for at least 2 Bcf/d of incremental gas pipeline capacity from the Permian to the Katy area (the Arrow Model’s Corridor D; dashed red oval to far right in Figure 3 below).

Figure 3. RBN Arrow Model Timeline. Source: NATGAS Arrow Model Report

The Arrow Model was developed to help a wide range of market players gain a deeper understanding of how the Texas/Louisiana gas market works today and how it will evolve month by month and year by year as regional gas production rises and shifts and new gas pipelines (orange and purple arrows in Figure 3), gas-fired generation and LNG export terminals (green and blue arrows) come online. As we explained in All Shook Up, the Arrow Model (1) aggregates gas production, demand and net outflows or inflows for each market hub over time; (2) quantifies the degree to which gas is pushed/pulled between and among hubs, again over time; (3) anticipates gas flows on each corridor (and the need for incremental pipeline capacity); and (4) forecasts the basis differentials that underlie and support the aforementioned flows of gas.

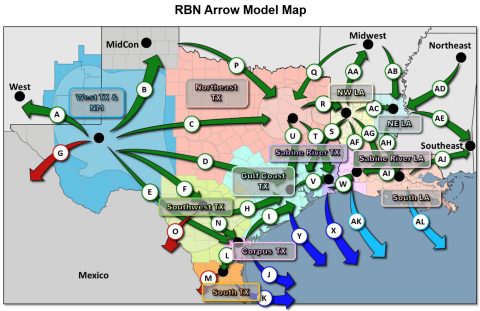

To help make sense of gas flows in a two-state region with tens of thousands of miles of gas pipelines, RBN carved the region into pipeline “corridors” that can be used to assess changes in the region’s inflows, outflows and flows within each state via groups of pipes that serve similar markets from comparable supply sources. These pipeline corridors (green arrows in Figure 4 below) are aggregations of dozens of pipelines connecting key market hubs. There also are six more corridors that track volumes from LNG terminals, through which gas exits Texas and Louisiana in liquefied form on LNG carriers (dark-blue and light-blue arrows, respectively). The red arrows show gas exports to Mexico.

Figure 4. RBN Arrow Model Map. Source: RBN Arrow Model Report

The Arrow Model indicates that the new pipelines and pipeline expansions being planned — including the WPC JV’s recently expanded Traverse Pipeline project (new capacity, 2.5 Bcf/d) — will be sufficient to avoid major constraints through the late 2020s. It also suggests that at least 2 Bcf/d of new capacity along Corridor D (West Texas to the Texas Gulf Coast) will be needed by the early 2030s to move incremental volumes from the Permian to the Katy area. WhiteWater’s newly announced Eiger Express would appear to fill that need on the early side. The next question for the Arrow Model — and gas market players — is, what’s needed next? Two possibilities are Energy Transfer’s recently announced, 1.5-Bcf/d Transwestern expansion from West Texas to the Phoenix area and Tallgrass Energy’s proposed pipeline from the Permian to the Rockies Express (REX) pipeline. Notably, neither of these projects would bring Permian gas to the Gulf Coast.

For more information about the RBN Arrow Model’s suite of services — a monthly report and Excel file packed with supporting data, a quarterly Arrow Model supplement, and an analyst-led onboarding presentation to get you up to speed — click here.

“Climb Ev’ry Mountain” was written by Richard Rodgers and Oscar Hammerstein; Rodgers wrote the music and Hammerstein wrote the lyrics. It appears as the eighth song on both sides of The Sound of Music soundtrack album. The song debuted at the end of the first act in the 1959 Broadway musical production and shows up as the first song in the second act of the film version. It serves as an inspirational piece to follow your dreams. Margery MacKay dubs actress Peggy Wood’s singing voice in the movie; Wood played the Mother Abbess at Maria’s convent. Tony Bennett, Andy Williams, The Fleetwoods, and Shirley Bassey all released covers of the song. Personnel on the record were: Julie Andrews (voice of Maria), Bill Lee (dubbed the voice of Christopher Plummer as Captain von Trapp), Margery MacKay (dubbed the voice of Peggy Wood), Charmia Carr, Nicholas Hammond, Heather Menzres, Duanne Chase, Angela Cartwright, Debbie Turner, Kym Karatta (von Trapp children), and Irwin Kostal (orchestra conductor).

The Sound of Music soundtrack album was recorded in 1964-65 and produced by Neely Plumb. Released in conjunction with the movie starring Julie Andrews and Christopher Plummer in March 1965, it went to #1 on the Billboard 200 Albums chart and has been certified Gold by the Recording Industry Association of America. Five promotional singles were released from the LP.

Rodgers and Hammerstein wrote 11 musicals together, including the Broadway hits Oklahoma!, Carousel, South Pacific, and The King and I. Oscar Hammerstein died in August 1960 in Doylestown, PA, at 65. Richard Rogers died in December 1979 in New York City at 77.

Julie Andrews is a British actress, singer and author. She has starred in 40 motion pictures and numerous television shows and stage productions. She has received an Academy Award (for Mary Poppins), six Golden Globe Awards, two Grammy Awards, and an American Film Institute Lifetime Achievement Award.

Christopher Plummer was a Canadian actor who appeared in 121 motion pictures and numerous television and stage productions. He won an Academy Award, two Tony Awards, two Primetime Emmy Awards, a Golden Globe Award, and a Screen Actors Guild Award. Plummer died in February 2021 in Weston, CT, at 91.