The European Union (EU) has had to rethink and reconfigure major elements of its policies around natural gas since Russia’s invasion of Ukraine in February 2022. Prior to the war, Russian volumes accounted for 45% of the EU’s imports of natural gas, nearly double the supply from second-place Norway, but Russian gas supplies have dropped considerably since then, impacting the global LNG market. In today’s RBN blog, we look at the EU’s continued efforts to reduce its reliance on Russia, how it’s trading supply risk for price risk, and what the changes could mean for U.S. LNG exporters.

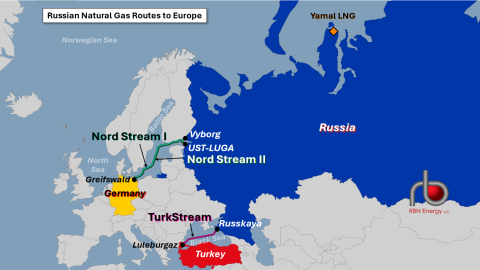

Just a few years ago, Russia was annually exporting 150 billion cubic meters (Bcm; 14.5 Bcf/d) of natural gas to Europe, including pipeline gas and LNG. But volumes have declined sharply, first due to the damage inflicted on the offshore Nord Stream pipelines (twin green lines in Figure 1 below) that connect Russia and Germany and second from the termination (at the end of 2024) of the last agreement to move Russian gas through Ukraine via pipeline to other parts of Europe. (Most of the Nord Stream system under the Baltic Sea was destroyed in a September 2022 explosion. Nord Stream 1 began service in 2011; Nord Stream 2 was completed in 2021 but never entered service.) Russian pipeline gas supplies to Europe are now limited to volumes imported via the TurkStream gas pipeline (pink line), which runs under the Black Sea and connects in Turkey, which delivered 16.7 Bcm (1.6 Bcf/d) to European customers in 2024, notably to Hungary (7.6 Bcm; 0.7 Bcf/d).

Figure 1. Russian Natural Gas Routes to Europe. Source: RBN

In contrast, Russian LNG derived from Novatek’s Yamal project (orange diamond at top of Figure 1) and three small facilities located in the Baltic Sea has not been as heavily impacted by political events. EU imports of Russian LNG rose by 18% from 2023 to 24.2 Bcm (2.3 Bcf/d) in 2024. This occurred despite the EU having previously imposed 16 different sets of sanctions on Russian energy supplies. (More on the impact of the 17th in a bit.) The cost of this gas was 21.9 billion euros ($24.9 billion), which exceeded the 18.7 billion euros ($21.2 billion) in financial aid the EU sent to Ukraine in the same year. By purchasing Russian gas, the EU has essentially been helping Russia finance its war with Ukraine.

Join Backstage Pass to Read Full Article