It’s shaping up to be an incredible year for U.S. LNG growth, with record levels of feedgas demand and exports along with progress on the regulatory front, as the Trump administration has cleared away hurdles that had previously stalled project development. Now, Cheniere Energy has announced a positive final investment decision (FID) on its Corpus Christi Midscale expansion. In today’s RBN blog, we take a closer look at the Midscale project and others that could move forward this year.

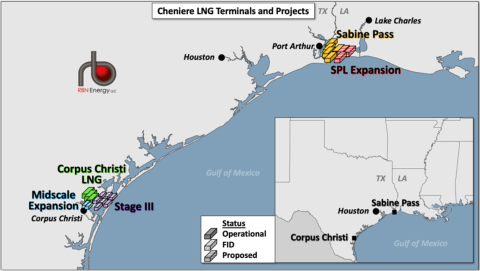

Cheniere’s Corpus Christi LNG terminal (solid green boxes in Figure 1 below), which is in San Patricio County, TX, and began operations in 2018, has three trains each capable of producing 5 million tons per annum (MMtpa; 0.66 Bcf/d) of LNG. Cheniere took FID on the Stage III expansion project (dotted purple boxes) at Corpus Christi in June 2022, a period when interest in U.S. LNG intensified as Europe scrambled to meet gas demand without piped-in Russian imports in the wake of the Russia-Ukraine war (see Help Is On The Way). From March 2022 to July 2023, five U.S. LNG projects with a combined 59.7 MMtpa (7.9 Bcf/d) of export capacity reached FID: Cheniere’s Stage III expansion, Venture Global’s Plaquemines Phases 1 and 2, Sempra’s Port Arthur LNG and NextDecade’s Rio Grande LNG (see King Creole). It was an unprecedented period of financial investment in the industry that will lead to U.S. LNG export capacity topping 185 MMtpa (24.5 Bcf/d) by late this decade. Now, as the first of those projects is starting to come online, we appear to be entering another period of commercial and financial momentum for the industry.

Figure 1. Cheniere LNG Terminals and Projects. Source RBN

Before we dive into Cheniere’s Midscale expansion (striped blue boxes), let’s take a closer look at the Stage III project, which has one train online and another commissioning. The project, which consists of seven modular trains for a total of 10 MMtpa, is Cheniere’s first foray into modular LNG trains. Train 1 has already been placed into service and Train 2 is commissioning and achieved first LNG in June. Trains 2 and 3 are both expected to reach substantial completion this year, with Trains 4 to 7 following suit next year. At full operations, the Stage III trains will require about 1.4 Bcf/d of feedgas and are likely taking in around 0.2-0.5 Bcf/d right now. (Stage III is exclusively taking feedgas from the ADCC Pipeline, an intrastate pipeline that runs from the Agua Dulce Hub in South Texas to the terminal. ADCC, in turn, receives Permian gas from the intrastate Whistler Pipeline, which means that from production to consumption, the entire flow happens on intrastate pipelines, which are not required to report flow data. That means visibility on daily feedgas is limited; however, the terminal has been exporting a record amount of LNG since Stage III’s Train 1 began producing.)

Join Backstage Pass to Read Full Article