The San Juan Basin in northwestern New Mexico and southwestern Colorado has seen more than its share of booms and busts in the last 100-plus years. During the Shale Era, natural gas production in the 7,500-square-mile basin has been slowly declining, undercut by competition from more prolific, better-situated wells in the Permian and Eagle Ford. But a small band of “San Juan believers” think the region is poised for yet another rebound, this time due to what they view as massive, untapped potential in the basin’s Mancos Shale. In today’s RBN blog, we discuss recent developments in the San Juan — and the basin’s extensive pipeline infrastructure.

It’s only natural that the RBN blogosphere focuses on the oil and gas production areas that post the biggest, most impactful numbers. Places like the Permian (of course), Marcellus/Utica, Bakken and Eagle Ford, plus (every so often) basins like the Haynesville, Denver-Julesburg (DJ), SCOOP-STACK and Powder River. But we’re also interested in what you might call the outliers (the waxy-crude Uinta in Utah, for example) and the quirky outposts within larger production areas (like the volatile oil window in the Utica Shale — now a hotbed of condensate production growth), especially if they have the potential to become bigger players in U.S. energy markets. And there’s a growing preponderance of natural gas producers and marketers looking at the next wave of liquefied natural gas (LNG) export facilities with an expectation that the massive increase in demand will spur prices that incentivize additional production from other regions that have long been overshadowed by the Permian behemoth, including places like the Anadarko, Green River, Western Haynesville and San Juan, among others.

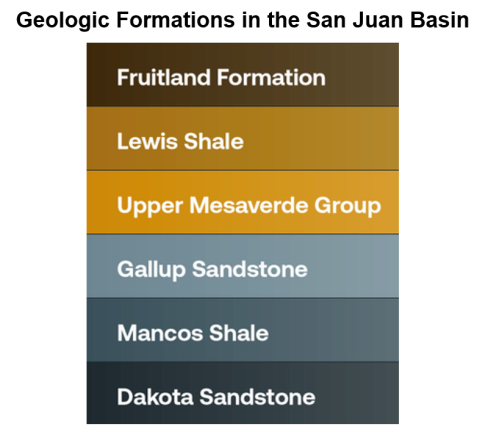

The San Juan Basin is primarily a natural gas producing region. Production there has been a bit of a roller-coaster since its start back in 1921, when the basin’s first commercially successful well was drilled near Aztec, NM. (Initial production, several million cubic feet per day — no slouch!) The challenge then was getting gas to market; the San Juan was hundreds of miles from large population centers and there was little to no pipeline infrastructure in place. The completion of the El Paso Natural Gas pipeline to California in the early 1950s spurred a boom in conventional gas production in the basin, and (after a handful of mini-booms and mini-busts) that was followed up in the 1980s and ’90s by a surge in coalbed methane production from the uppermost Fruitland Formation (dark-brown layer in Figure 1 below). By 2000, the San Juan Basin was among the U.S.’s top gas production areas, churning out nearly 4.5 Bcf/d of gross gas, or about 8% of total U.S. onshore production at the time.

Figure 1. Geologic Formations in the San Juan Basin. Source: Novi Labs

Join Backstage Pass to Read Full Article