The build-out of the Permian’s midstream infrastructure over the past 10 years has created extraordinary opportunities for startup companies, most of them backed by private equity. Each of us could cite several examples of midstreamers that, with a combination of guile and grit, developed gathering systems, gas processing plants, pipelines and other infrastructure to serve the fast-growing needs of producers and shippers. In many cases, the assets they constructed were later sold — often at a hefty profit — to much larger firms. As we discuss in today’s RBN blog, even in the midst of sector consolidation, the entrepreneurial spirit of smaller Permian midstreamers continues.

Who among us hasn’t watched with admiration (and maybe a little jealousy) as prescient developers in the Permian’s Midland and Delaware basins built out important sets of infrastructure over just a few years, then monetized their investments with eye-popping, lucrative sales to midstream giants and big-fish asset managers? Deals like Stonepeak Infrastructure Partners’ acquisition of Oryx Midstream; Targa Resources’ purchase of Lucid Energy Group; Enterprise Products Partners’ buyout of Navitas Midstream Partners; ONEOK’s takeover of the Midland portion of Medallion Midstream; and Morgan Stanley Infrastructure Partners’ purchase of Brazos Midstream. And don’t forget that just two weeks ago, MPLX announced an agreement to buy Northwind Midstream, a leading sour-gas gatherer/treater, for $2.375 billion.

You don’t need to squint to see the pattern here. In every case, the sellers were private-equity-backed midstream companies formed to pursue opportunities in the Permian and led by highly experienced, go-getting executives with a seemingly innate ability to identify which projects would be needed where and when. These midstream execs and their backers also had a knack for knowing when to sell. As we discussed in our Waltz Across Texas Drill Down Report in May, several large midstream companies — Energy Transfer, Enterprise, MPLX, ONEOK, Phillips 66 and Targa among them — have been expanding their Permian-to-Gulf-Coast networks for gathering, processing, transporting and exporting crude oil, natural gas and NGLs. Their ongoing competition to bolt on additional assets in key areas has made the mid-2020s a great time to cash in.

Sure, a lot of Permian infrastructure has already been developed, a lot of privately held midstream companies have sold what they built out, and still more deals are in the works. But it’s important to keep in mind that private-equity-backed midstream development continues apace, with a band of smaller private companies striving to duplicate what Brazos, Lucid, Medallion, Navitas, Northwind and Oryx achieved by seeking out opportunities to develop midstream assets that may well become attractive acquisition targets down the road.

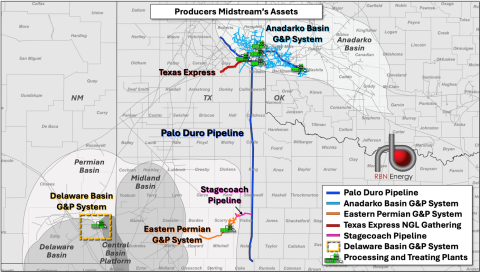

In today’s blog, we’ll focus on one such up-and-comer. Producers Midstream, a portfolio company of Tailwater Capital, has been building a collection of midstream assets in the Permian’s Delaware Basin and Eastern Shelf — and the Anadarko — and recently (1) announced plans to expand its gas gathering and processing system in Lea County, NM, and (2) initiated an open season for an interstate pipeline project that would provide a new, northbound outlet for Permian-sourced gas.

First, a little background. Producers Midstream II was formed in 2019 with backing from Tailwater to pursue midstream opportunities in the Permian. Its initial focus was the Strawn Sands region in the Permian’s Eastern Shelf on the periphery of the Midland Basin. In the heart of the Strawn Sands in West Texas’s Fisher and Scurry counties, Producers Midstream in 2020 completed a 70-mile gas gathering system (orange lines in Figure 1 below) and the 60-MMcf/d White Wing gas processing plant (green plant icon at lower-center). The following year, the company added a nitrogen-rejection unit (NRU) at White Wing and continued expanding the gathering system to its now 160-mile network of low and high pressure pipelines. (See It’s a Gas Gas Gas for more on nitrogen rejection in the Permian.)

Figure 1. Producers Midstream’s Assets. Source: RBN

Join Backstage Pass to Read Full Article