So far in 2013 around 645 Mb/d of new crude oil pipeline capacity has opened up to ship supplies to the Texas Gulf Coast. Early this month (December) line fill starts on the largest new capacity addition to date – the 700 Mb/d Keystone Gulf Coast Pipeline. The new pipeline runs from Cushing to Port Arthur and will carry mostly Canadian heavy crude. Today we wonder if all that crude will find a home.

The first episode in this series described 4 MMb/d of current and planned expansions to crude transportation capacity into the Texas Gulf Coast region (see Handling The Texas Gulf Coast Crude Flood). Our analysis showed that the new incoming light crude capacity will exceed Texas Gulf Coast demand by somewhere north of 0.5 MMb/d by the end of 2015. In episode two we described how some of these excess crude supplies would move east on the reversed Ho-Ho pipeline (see Gulf Coast Crude West to East Flows). In episode three we looked at how shippers could divert supplies away from Texas Gulf Coast congestion (see Texas Gulf Coast Bypass Options). This time we consider the impact of the Keystone Gulf Coast pipeline.

One of the more confusing features of the Keystone Gulf Coast Pipeline is what to call it – the name seems to change in real time. That is probably due to a desire to disassociate the southern Gulf Coast section of the pipeline from delays in permitting the Canada to US Keystone XL pipeline. Owner and operator TransCanada most recently set up a subsidiary to operate the pipeline called Marketlink LLC and it should now apparently more properly be called the Cushing Marketlink Pipeline so we will go with CMP as an abbreviation.

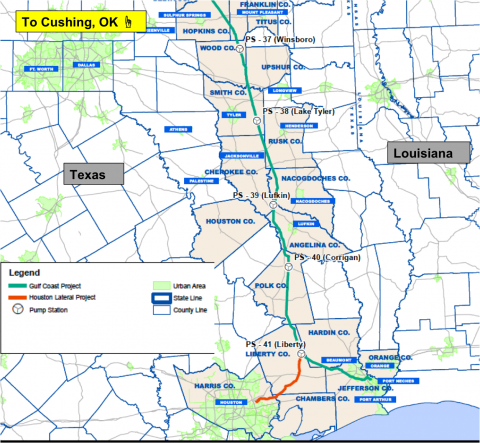

The 36-inch-diameter CMP runs 485 miles from Cushing, OK, to Nederland, TX (see green line on the map below). The line will have an initial capacity of 700 Mb/d with the option to expand to 830 Mb/d. It is almost ready to commence operations but before that can happen it has to be filled with oil – a process known as “line fill”. We described how line fill works and provided a formula to approximate the volume of oil required back in May 2012 (see A Time for Gas A Time For Crude – Part 2). According to that formula CMP requires 3.5 MMBbl of line fill. Marketlink LLC has said the first pipeline deliveries will be made before the end of 2013. The company is also constructing a 48-mile Houston Lateral pipeline (orange line on the map) that will run from the Liberty pumping station to East Houston and should be online by the end of 2014 with 130 Mb/d capacity.

Source: TransCanada Website and RBN Energy (Click to Enlarge)

The initial destination of the CMP is the Sunoco Logistics (part of Energy Transfer Partners) Nederland terminal. We have covered the Nederland terminal in two previous blog posts (see Nederland Crude Wonderland and Nederland Crude Volume Surges). The terminal is located on the Sabine-Neches waterway between Beaumont and Port Arthur, TX and has 22 MMBbl of storage capacity (see map below). The location is in the heart of Beaumont/Port Arthur refining country – home to four large refineries owned by ExxonMobil (Beaumont, 365 Mb/d), Valero (Port Arthur, 310 Mb/d), Total (Port Arthur, 174 Mb/d) and Shell/Saudi Aramco (Motiva 600 Mb/d). The Sabine Neches Waterway connects to the Gulf of Mexico, providing waterborne access to the entire Gulf Coast region. Nederland is about 100 miles East of Houston and 350 miles West of New Orleans.