As if there weren’t enough reasons to add new natural gas pipeline capacity through New England, it’s time to consider another: the Sable Island and Deep Panuke gas production areas off the coast of Nova Scotia are quickly losing their oomph, and soon the Canadian Maritimes will need to rely more heavily on gas from other, more distant sources, including the Marcellus. Developing pipelines to move large volumes of Marcellus gas through New England to New Brunswick and Nova Scotia will not be easy though. Today we continue our look at the challenges of supplying gas to New England and its northern neighbors.

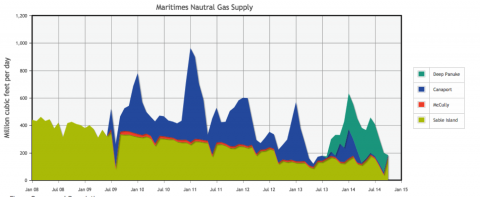

The gas supply/demand dynamic in the Canadian Maritime provinces of New Brunswick and Nova Scotia adds another layer of complexity to the situation in New England, which already struggles with gas supply during very cold winter days. The Sable Island Offshore Project (SIOP) and Deep Panuke discoveries once were viewed as the next big things for New England gas supply (see Is Late-Arriving Deep Panuke Gas a Case of “Right Time, Wrong Place?”). SIOP started producing in December 1999, and was the first to use the 800 MMcf/d Maritimes & Northeast Pipeline (MNP), which runs 730 miles from Goldboro, NS to near Boston. SIOP for a time was a big deal, producing more than 350 MMcf/d through most of its first 10 years. But in the past five years production has steadily declined (see light olive green layer in Figure #1); in January 2015 it produced only 175 MMcf/d, and gas flows are expected to continue falling until SIOP is shut down a few years shy of its predicted 25-year lifespan. Deep Panuke had been seen as a supplement to--and eventual replacement for—SIOP (and for liquefied natural gas imported through the Canaport terminal in Saint John, NB; blue layer in Figure #1), but it’s turned into something of a disappointment. For one thing, Deep Panuke came online more than three years behind schedule, producing its first gas in August 2013, by which time Marcellus production was approaching 12 Bcf/d (Marcellus/Utica production now tops 19 Bcf/d). For another, Deep Panuke’s production levels—originally targeted at 400 MMcf/d, then dialed back to 300 MMcf/d—fell short of expectations. Production peaked in January 2014 at 282 MMcf/d (teal green layer) and owner Encana Corp. has since decided to focus Deep Panuke production on the winter months (when gas demand and prices are higher). In February 2015 Encana also reduced its estimate for remaining gas reserves at Deep Panuke to 80 Bcf, from its earlier estimate of 200 Bcf. (There’s one other gas producing area in the Canadian Maritimes: the McCully Field near Sussex, NB (orange layer), but it’s a very minor player.) All this suggests that offshore Nova Scotia gas production will be playing a smaller and smaller role.

Figure #1; Source: National Energy Board (Click to Enlarge)

Meanwhile, natural gas consumption in New Brunswick and Nova Scotia has risen from near zero in the late 1990s (when there was virtually no local production) to more than 200 MMcf/d during the winter months today, with more than 90% of that demand coming from the power and industrial sector. (Gas consumption generally tops 100 MMcf/d—and often 150 MMcf/d—the rest of the year.) And the Maritimes could use a lot more gas (especially if it were cheap), not only to help keep its power costs low and its industries competitive, but also to export Marcellus gas as LNG through Canaport and several other LNG export projects now under development. As we said in “Movin’ Out—Exporting U.S.-Sourced LNG Through the Maritimes”, Pieridae Energy (Canada) Ltd. has been developing a project to export up to 10 million metric tons per year (MTPA) or 1.5 Bcf/d of LNG from a proposed LNG terminal in Goldboro, NS (see Figure #2); it already holds a 20-year deal under which E.ON Global Commodities SE, a subsidiary of the German energy giant, will take 5 MTPA, or half the Goldboro project’s capacity. (And, in a twist from the Western Canadian model, the Goldboro LNG price would be indexed to European gas hub prices, and not to oil—a potential plus for European and other LNG buyers.) Pieradae is said to be in talks with another major LNG buyer, as well as with potential gas suppliers in the Marcellus; it’s also seeking Federal Energy Regulatory Commission (FERC) approval to export gas to Canada.

I’ll Take You There: NGL Infrastructure in the Permian Basin and the Eagle Ford

We have released our second 2015 Drill-Down report for Backstage Pass subscribers providing NGL production forecasts and an inventory of takeaway infrastructure for the Permian and Eagle Ford

More information about I’ll Take You There here.

Join Backstage Pass to Read Full Article