Natural gas from the Deep Panuke field off Nova Scotia will start flowing any day now. But it is arriving three years late, and a lot has changed since 2010. Most important for Repsol, the exclusive marketer of Deep Panuke gas, the New England market that was supposed to be the primary buyer is being courted by sellers of now-abundant Marcellus gas. And Spectra Energy, Kinder Morgan and others are building and planning the pipeline capacity needed to reliably deliver large volumes of gas to New England from the Marcellus. Today we conclude our two part analysis of the impact that this new supply will have on the region.

In Part 1 of “Right Place, Wrong Time?” we looked at how the Deep Panuke discovery once was seen as the next big thing for New England gas supply, and as a follow-up to the Sable Island Offshore Project (SIOP)—also off Nova Scotia—which was the first to use the Maritimes & Northeast pipeline into New England. We also examined why it has taken so long to get Deep Panuke gas flowing. In Part 2, we consider what might happen as the new southward flow of Deep Panuke gas collides with the opposing flows of Marcellus gas—through soon-to-be beefed-up Algonquin Gas Transmission (AGT) and Tennessee Gas Pipeline (TGP) networks—to New England.

Demand for natural gas in New England has been rising, and is likely to keep doing so. Electric utilities and independent power companies in the region are shifting to gas-fired generation for economic and environmental reasons, and businesses and homeowners there are looking for lower cost alternatives to oil for space heating. According to the U.S. Energy Information Administration (EIA) gas consumption in New England totaled 929 Bcf in 2012 (estimate based on available EIA data ), up from 711 Bcf in 2007. Gas for power generation accounts for about half of total usage in the region, and it has been rising fast; in 2012 gas-fired units generated 52% of New England’s electric power, up from less than 15% in 2000.

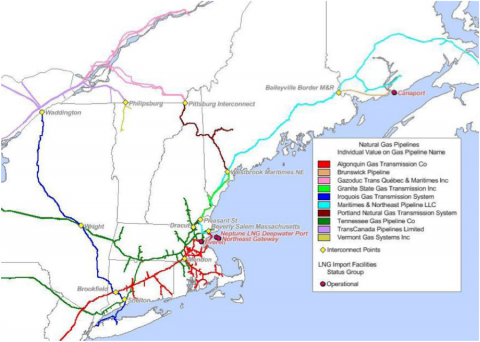

But there are only a few ways to move gas into New England: pipelines from New York, pipelines from Canada, or through LNG import terminals north of Boston (see red dots on Figure 1 below). LNG is not really in the picture now; with U.S. shale gas abundance and low prices here, those potential imports are being shipped elsewhere. That leaves pipelines. Gas production in the Marcellus has been soaring, of course, but while the capacity of the pipeline network to move Marcellus gas through New York and into New England is rising gradually it has not kept pace, and it may be a few years before it catches up. According to the EIA, pipelines from New York could only move as much as 3.54 Bcf/d across the state line into Connecticut and Massachusetts in 2012, up from 3.12 Bcf/d five years earlier. (There are no pipelines from New York into Vermont.)

Figure 1 - Source: New England ISO: Assessment of NE Natural Gas Pipeline Capacity For Electric Generation (Click to Enlarge)

New England still receives natural gas supplies by pipeline from Canada from two sources. The first of these is supplies from Western Canada that reach Eastern Canada on the TransCanada mainline system and feed across the border: into New York on the Iroquois Gas Transmission System (blue line on Figure 1); into Maine on the Portland Natural Gas System (brown line on Figure 1); and into Vermont via Vermont Gas Systems (yellow line). However, the volume of these supplies that come from Canada is now declining because flows of gas east on the TransCanada system from Niagara are now increasingly supplied from the Marcellus via New York. Marcellus supplies crossing the New York border into Ontario are pushing Western Canadian supplies out of Eastern Canada (see Flowing Marcellus Gas into Eastern Canada). The second pipeline source of Canadian gas is SIOP production via the Maritimes pipeline. But that has also been falling fast. In the first five years after it started producing in late 1999, SIOP averaged about 400 MMcf/d, but by 2010 daily production was down by half or more, and ExxonMobil is making plans to wind down the project over the next few years. And while New England initially had been seen as the primary market for SIOP gas, a quickly increasing share of SIOP production is being consumed in either Nova Scotia or New Brunswick. Of the roughly 190 Bcf of SIOP gas produced in 2001, for example, 95% was exported to New England, but in 2011 only about 100 Bcf was produced, with only 26%--or 26 Bcf--finding its way south across the U.S.-Canada border.

Enter Deep Panuke—three years late. Deep Panuke gas at first was supposed to start flowing south through the Maritimes & Northeast Pipeline (MNP) into Maine, New Hampshire and Massachusetts in 2010, then 2011, then 2012, and now sometime in the third quarter of 2013. Encana--Deep Panuke’s developer--and Madrid-based Repsol, its marketer for the life of the project, per a 2009 agreement—expect up to 300 MMcf/d to come ashore. How much is actually produced, how much is sold for consumption in Nova Scotia and New Brunswick, and how much makes its way into New England remain to be seen. All that will depend, of course, on demand, and gas prices. Encana figures there is about 13 years of life in the Deep Panuke reserve, and Repsol’s best hope for making a big marketing splash in New England may be in the near term, because by 2016 new pipeline capacity from New York into New England will enable a lot more Marcellus gas to move into the region.

Join Backstage Pass to Read Full Article