Just a couple of days after we talked here in Marcellus Changes Everything about the rupture in the space-time continuum’ between Tennessee pipeline’s Marcellus Zone 4 and the market area Zone 6, prices really blew out. Zone 6 traded last Wednesday at almost $8.50/MMbtu, responding to hot weather, nuclear outages and pipeline maintenance. Poor Marcellus actually fell to $0.88/MMbtu on Tuesday, before seeing some response to the blowout 100 miles down the road and getting to $1.75 on Thursday. But that only lasted as few hours. See our updated Zone 6 versus Zone 4 differential graph below. Why would we see such a blowout this time of year? Is this the kind of price behavior we can expect in the Northeast in the shale era? Today we’ll take a look at these questions and more related to Marcellus shale production and natural gas pipeline capacity in the Northeast.

As usual, it was a combination of events that resulted in the blowout. The primary driver was hot weather from Boston down to New York. For example, on Wednesday the temperature in Boston was in the mid to upper 90s. Usually it is in the upper 70s this time of year. That cranked up air conditioning demand. But at the same time two nuclear reactors were cut back – one in Vermont and the other near Philadelphia. So it was higher demand and lower supply. The only choice for utilities in the area was to crank up the natural gas peakers. And wouldn’t you know it, Algonquin – the main pipeline that feeds Boston – chose just that time to do some maintenance on their line, restricting all but firm contractual deliveries via one its most important compressor stations (Cromwell). Actually Tennessee was planning some maintenance too, but changed its mind when the weather and nuke problems hit.

Check out Kyle Cooper’s weekly view of natural gas markets at http://www.rbnenergy.com/markets/kyle-cooper |

With all the new production coming on in the Marcellus, why can’t more gas get to Northeast markets when this sort of thing happens? Of course, it is capacity constraints. There are six major pipelines that supply the Northeast region from the west and south – Tennessee (Kinder Morgan), TETCO (Spectra), Iroquois (TransCanada), Dominion Transmission (Dominion), Columbia Gulf a.k.a. TCO (Nisource) and Transco (Williams). All of these pipelines were built with the primary intent of moving gas into the Northeast markets in the winter from supply points in the Gulf Coast (Tennessee, TETCO, Columbia Gulf, Transco), Canada (Iroquois) and Dominion (regional production and gas from various interconnected pipelines across Ohio, West Virginia, western Pennsylvania and upstate New York). These pipelines traditionally have moved gas into regional storage located mostly in Ohio, Pennsylvania and western New York during the storage injection season (April – October), then they take gas out of storage to meet peak winter demand.

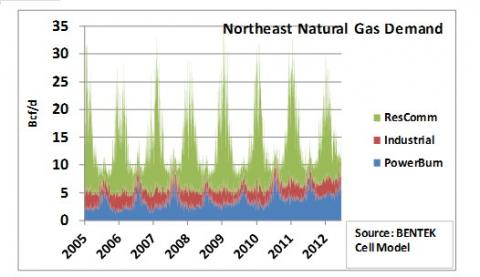

The graphic below from BENTEK’s Cell Model data will help put that huge swing in winter demand in perspective. The blue area is ‘PowerBurn’, the gas used for gas fired power generation. Note that it definitely moves higher in the summer, and has generally been increasing each year since 2005 as natural gas has captured more of the power generating load. Industrial demand (red area) has been about flat, increasing in the winter as heating demand from industrial facilities uses more gas. But both of these sectors pale in comparison to the huge swings in the demand for natural gas from the ResComm (residential and commercial sectors – green area). Demand spikes from summertime loads that are sometimes less than 2 Bcf/d up to peak winter demand on the coldest day above 30 Bcf/d. Now that’s a swing in demand.

The only way the natural gas industry can meet that demand is with storage. Huge amounts of storage. More natural gas storage than anywhere else in the world. There is a total of 2.3 trillion cubic feet (TCF) of working gas storage capacity in the region. That is 52% of all the storage capacity in the U.S., which is currently estimated by EIA at 4.4 TCF of working gas capacity. (Note that this number is theoretical. Maximum capacity has never been tested.)

Join Backstage Pass to Read Full Article