On the surface, the Bakken story in the mid-2020s may seem as boring as dirt. The boom times of 2009-14 and 2017-19 are ancient history. Crude oil production has been rangebound near 1.2 MMb/d — well below its peak five years ago. And that output has been getting gassier over time, creating natural gas and NGL takeaway constraints that have put a lid on oil production growth. But don’t buy into the view that the Bakken is yesterday’s news. Beneath the surface (sometimes literally), the U.S.’s second-largest crude oil production area is undergoing a major transformation that includes E&P consolidation, production (and producers) going private, the drilling of 3- and (soon) 4-mile laterals, novel efforts to eliminate flaring, and even a producer-led push for CO2-based enhanced oil recovery (EOR). As we’ll discuss in today’s RBN blog, these changes and others may well breathe new life into the Bakken and significantly improve the environmental profile of the hydrocarbons produced there.

Way back in 2012 — Year 1 in the RBN blogosphere — blogs about the Bakken were a regular thing. Everyone was mesmerized by that amazing shale play in western North Dakota and the eastern edge of Montana, where fast-growing volumes of crude oil and associated gas were being wrung out of seemingly impenetrable shale thanks to that dynamic duo of horizontal drilling and hydraulic fracturing. Sure, the drilling-and-completion techniques were far less sophisticated than they are now, but the production was rising fast enough to spur a frenetic infrastructure buildout. Folks were scrambling just to keep up. By 2014, Bakken oil production was topping 1.1 MMb/d — 11X the early-2009 level — and three-quarters of it (800 Mb/d!) was being loaded into tank cars and railed out because there wasn’t near-enough pipeline capacity to handle the gushing volumes.

Then came the mid-decade crude oil price crash, which sent Bakken production falling to less than 900 Mb/d by late 2016. It bounced back, though — by late 2019, the play’s output was topping 1.4 MMb/d until another price crash, this time brought on by a global pandemic. Production gradually rebounded post-COVID, but with far less oomph than in 2017-19. As we said in the introduction to today’s blog, Bakken crude output has hovered around 1.2 MMb/d in recent months.

So what’s been keeping Bakken production close to flat? A primary reason is the Bakken’s competitive disadvantages to the Permian, the U.S.’s largest production area, which offers lower breakeven prices and easier, cheaper access to key Gulf Coast refinery and export markets. In fact, while Permian production growth itself has stalled in recent months (see All My Rowdy Friends Have Settled Down), the sprawling West Texas/Southeast New Mexico shale play accounted for the entirety of U.S. production growth in 2022-23. Also, as we discussed earlier this year in Take It to the Limit, looming natural gas and NGL takeaway constraints in the Bakken have put a cap of sorts on crude oil production. (We’ll revisit and update the constraints issue later.)

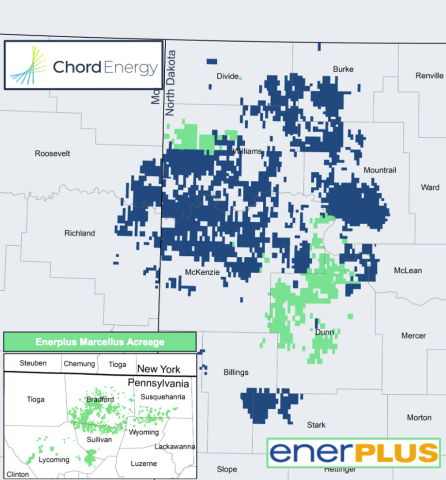

Figure 1. Chord Energy and Enerplus’s Acreage in the Bakken (and Enerplus’s Acreage in the Marcellus). Source: Chord Energy

Join Backstage Pass to Read Full Article