In North Dakota’s Bakken production region, crude oil is king. The light, sweet crude produced there is attractive to buyers in the Midwest and Gulf Coast and is the primary driver of producer economics in the basin. And when the crude is produced, it comes along with a healthy dose of NGL-rich associated natural gas. But while those are valuable products in their own right, providing economic uplift when sold, it’s a double-edged sword. Natural gas and NGL volumes are increasing rapidly and will soon test the limits of takeaway capacity, with the potential to disrupt not only those commodities but also the crude production with which they’re associated. In today’s RBN blog, we discuss three potential limitations faced by Bakken producers: natural gas pipeline capacity, NGL pipeline capacity and, at the fulcrum of those two, the Btu heat content of the gas being piped out of the basin.

Back in 2019, before COVID brought demand, prices and then production crashing down, the Bakken looked like it was in a pickle, with natural gas and NGL production growing faster than takeaway capacity (see Push and Shove). The volume decline during the pandemic may have bought a reprieve but it looks like that time is just about up. Crude oil production is back up over 1.3 MMb/d (still short of the pre-pandemic high of 1.5 MMb/d) but natural gas production has grown much faster — so much so that takeaway of those products may be a limiting factor on crude production growth.

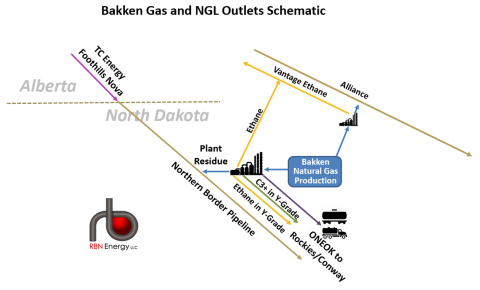

Gross associated gas in the Bakken, which is richly saturated with NGLs (some with more than 9 gallons-per-Mcf, or GPM), is up to more than 3.4 Bcf/d, or 9% higher than the 2019 peak. As we’ve said time and again, that’s been propelled by a steadily increasing associated gas-to-oil ratio (GOR). Some of that wet gas stream moves out on Enbridge and Pembina’s Alliance pipeline, which was designed to transport NGL-rich gas (the roughly 130 MMcf/d of gas flowing on the pipe has an estimated 25 Mb/d of liquids entrained within it). But the majority of the gas produced in the Bakken must first be processed (plant icons in Figure 1 below) to have most of the NGLs (and impurities, etc.) stripped out, causing the gas volume to shrink and the Btu content to decline. After processing, these residue gas volumes are now up to more than 2.4 Bcf/d, or 13% higher than the 2019 peak, and recovered NGLs are up to over 450 Mb/d! And therein lies the dilemma: All that volume growth will put pressure on the infrastructure providing egress.

Figure 1. Bakken Natural Gas and NGL Schematic. Source: RBN

Join Backstage Pass to Read Full Article