For the past decade, producers in the Permian Basin have been the driving force in domestic production growth, but lately there has been a hard-to-miss slowdown in incremental production rates for crude, gas and natural gas liquids (NGLs). While Permian producers are primarily motivated by crude oil economics, those volumes also come with a lot of associated natural gas and NGLs. These commodities are therefore fundamentally interlinked. So if there’s a hangup with one, the effects will be felt across the upstream and then cascade downstream. There is a lot of money riding on these markets and the impacts of an extended slowdown in the Permian could be monumental, not just in the energy industry but also in the broader U.S. and global economies. In today’s RBN blog, we will examine what’s to blame for plateauing production in the U.S.’s most prolific basin and gauge what its big-picture implications might be.

Warning! Today’s blog is, in part, a subliminal advertorial for RBN’s upcoming School of Energy which will highlight the interlinkages of commodity markets. The conference will be held on June 26-27 in Houston at the Houstonian.

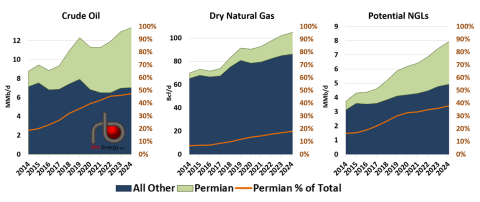

The rebirth and rise of the U.S. energy sector has been among the brightest spots in the domestic economic picture over the last 15 years, leading to a renaissance in industrial production, a huge reduction in the U.S. trade deficit, and energy independence from adversarial energy-producing countries. Over that time, the Permian has been a consistent driver of production growth of what RBN terms the “drillbit hydrocarbons”: crude oil, natural gas and NGLs. While the focus of Permian producers has always been on the crude stream, this crude oil comes with significant amounts of natural gas and NGLs. As shown in Figure 1 below, the shale play in West Texas and southeastern New Mexico has accounted for an ever-increasing proportion (orange lines and right axes) of overall domestic production of each commodity. Today, the Permian produces nearly half of all U.S. crude, about 20% of the country’s dry natural gas and almost 40% of its NGLs (ethane, propane, butane, isobutane and pentanes+) from processing.

Figure 1. The Permian’s Share of U.S. Production. Source: EIA

Join Backstage Pass to Read Full Article