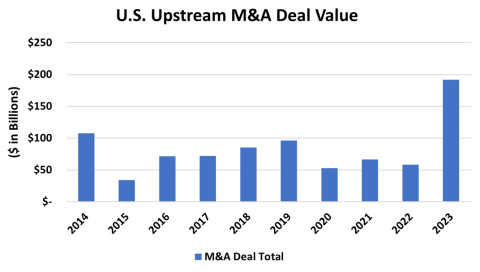

Brutal arctic cold may have chilled broad swaths of the U.S. last month, but the scorching pace of upstream M&A activity continued to be red hot, with nearly $20 billion in deals announced in January after a record-setting 2023. Last year’s transaction value totaled an astounding $192 billion, a mark 79% higher than the previous 10-year high and more than the previous three years combined. Why the surge? A wide range of factors influenced corporate decisions to grow through acquisitions rather than organic investment, including commodity prices, equity values, debt levels, operating costs, and production trends. In today’s RBN blog, we’ll analyze M&A trends through several statistical lenses and provide some insights into 2024 activity.

Figure 1 below, which illustrates the total value of upstream M&A transactions over the past 10 years, shows what a standout year 2023 was. And last year closed on a high note: The $144 billion in transaction value in Q4 alone surpassed the previous annual high of $107 billion in 2014. Q4 M&A activity was dominated by three major industry mergers, including ExxonMobil’s $59.5 billion purchase of Pioneer Natural Resources, Chevron’s $53 billion takeover of Hess Corp., and Occidental Petroleum’s $12 billion acquisition of privately owned CrownRock. One other data point: Upstream M&A last year was overwhelmingly tilted toward crude oil, with $186 billion in deals targeting oil-focused companies compared with just $6 billion in gas-focused transactions. And — no surprise here — the Permian Basin dominated the regional distribution of the deals, with $103 billion in 2023 acquisitions, with a record average deal size of almost $4 billion.

Figure 1. U.S. Upstream M&A Annual Deal Value. Source: Enverus

Join Backstage Pass to Read Full Article