In just a few years, the Uinta Basin has morphed from a quirky, waxy-crude curiosity to a burgeoning shale play with production north of 170 Mb/d and initial production (IP) rates that compare favorably with the best wells in the Permian. Still, there are a host of logistical challenges associated with transporting waxy crude out of the basin and questions have remained about the Uinta’s potential for growth and its staying power. In today’s RBN blog, we begin an in-depth look at the basin — with an assist from our friends at Novi Labs, whose innovative use of AI and machine learning provides valuable insights.

The Uinta’s waxy crude has inspired some of RBN’s most memorable blogs — Do Ya’ Think I’m Waxy?, Where You From, You Waxy Thing? and Bringing Waxy Back, to name just a few. The gist of most of those analytical explorations (especially the earlier ones) was that while the black and yellow waxy crudes emerging from wells in northeastern Utah have some great qualities — medium-to-high API gravity and very low levels of sulfur, acids, metals and nitrogen — the volumes produced were relatively modest. The crudes were (and still are) bears to deal with, largely limiting their sales to the five refineries in the Salt Lake City area, a few complex refineries along the Gulf Coast, and (with some important limitations) the Cushing, OK, crude oil hub for blending with light sweet crude to create a fully compliant Domestic Sweet (DSW) barrel.

But producer and refiner interest in Uinta waxy crude has been on the rise — and, as we’ll get to, so has the industry’s ability to predict well performance in different areas (and different benches) within the play and how much of the Uinta’s crude can be economically extracted at different price points. For E&Ps, the interest is spurred by their ever-improving understanding of the Uinta’s geology and their success in wringing ever-larger volumes of crude per linear foot from the Uteland Butte and Castle Peak benches within the lower reaches of the Green River formation — and as we said in the introduction to today’s blog, IP rates in the heart of the Uinta are nothing short of phenomenal. (Much more on that later.)

A select group of refiners, in turn, like waxy crude for many reasons, including its:

- Sweet-spot range of API gravities (32 to 36 degrees for black wax and 38 to 44 for yellow), which is ideal for many refineries.

- High paraffin content, which is essential for producing high-end lubricant base.

- Very low sulfur content (0.01%), low acid content (TAN, or total acid number, of less than 0.1%), and de minimis metals and nitrogen content — a nearly pure environmental profile that reduces processing costs.

- Balanced distribution across boiling range cut points — refiner-speak for crude that yields a relatively even or desirable proportion of all distillation products (gasoil, kerosene, etc.) when it’s distilled (separated by boiling point).

- Lucrative blending opportunities with light sweet crude, which the Permian and most other U.S. shale plays produce in abundance. (As we said, that blending can create DSW, the crude quality deliverable on the CME/NYMEX futures contract.)

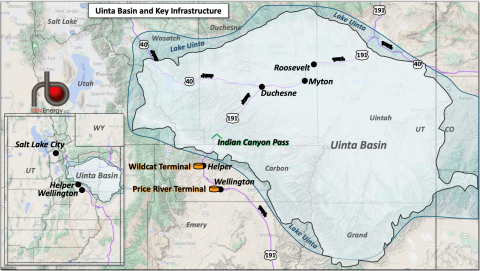

Figure 1. Uinta Basin and Key Infrastructure. Source: RBN

Join Backstage Pass to Read Full Article