Thanks largely to the Denver-Julesburg (DJ) Basin, Colorado ranks fourth among the 50 states in crude oil production, topped only by Texas, New Mexico and North Dakota — and, if it were a state, the offshore Gulf of Mexico (GOM). It’s also noteworthy that more than 80% of Colorado’s oil production comes from one county — Weld, the heart of the DJ and an hour’s drive northeast of Denver — and that a lot of consolidation has been happening in the DJ’s upstream and midstream sectors. In today’s RBN blog, we’ll look at the DJ Basin and the increasing concentration among the producers and midstreamers active there.

When it comes to crude oil, the Permian Basin seems to get just about all the attention and what’s left goes mostly to the Bakken, the Eagle Ford and the GOM. “SCOOP/STACK” and “Alaska North Slope” won’t be uttered on many Teams or Zoom calls today and it’s only slightly more likely that you’ll hear “DJ Basin.” But as we hinted at in our introduction, the DJ is a significant crude oil producer, with Weld County alone producing about 360 Mb/d in recent months and the rest of northeastern Colorado chipping in another 60 Mb/d or so.

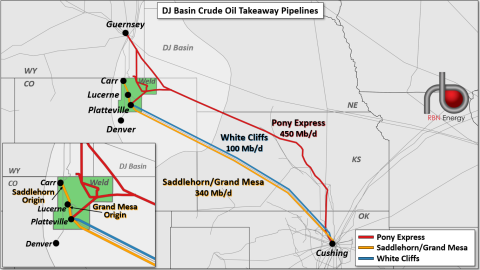

As we said in our 2020 Drill Down Report on the DJ Basin, rapid growth in the play’s crude oil production in the second half of the 2010s led to a major buildout of crude gathering systems, storage and takeaway pipelines. That — and a leveling off in DJ production in the early 2020s — has left market participants in good shape from an infrastructure perspective, with more than enough capacity to move their crude from the lease to the Cushing, OK, oil hub. The primary long-haul pipelines out of the DJ are the Saddlehorn/Grand Mesa (yellow line in Figure 1 below), White Cliffs (blue line) and Pony Express (red line) systems, which together have the capacity to move almost 800 Mb/d of oil from the DJ (and other production areas to the north) to Cushing.

Figure 1. DJ Basin Crude Oil Takeaway Pipelines. Source: RBN

Join Backstage Pass to Read Full Article