Western Canadian crude oil production is rising fast. To keep pace, Enbridge is planning expansions to its pipelines into the Midwest and Great Plains. But PADD 2 refineries are maxed out on heavy crude, so virtually all those incremental barrels will need to keep flowing south to refineries and export terminals along the Gulf Coast. Can the pipelines from PADD 2 to PADD 3 handle the higher volumes? In today’s RBN blog, we discuss the knock-on effects of rising Western Canadian production and Enbridge’s pipeline expansions.

A few months ago, in Here, There and Everywhere, we examined Enbridge’s plan to spend up to C$2 billion (US$1.5 billion) by 2028 to improve the efficiency and reliability of its 3.28-MMb/d Mainline pipeline system from Alberta to the Midwest that the midstreamer has said will increase its 96% utilization rate by 1% or 2%. Enbridge also is investing another C$1.5 billion (US$1.1 billion) by 2027 on a multiphase optimization project that will boost the system’s capacity by 150 Mb/d — and maybe more, if demand warrants. In addition, the company is looking to add up to 30 Mb/d of capacity to its 310-Mb/d Express-Platte pipeline system, which runs from Hardisty, AB, to Wood River, IL, just west of the Patoka, IL, crude oil hub. Enbridge has hinted that further expansions to Express-Platte are possible.

More recently, in You’ve Got a Friend in Me, we discussed our latest forecast for Western Canadian crude oil production and stacked that up against available and planned pipeline capacity out of the region. The bottom line? Even with the May 2024 startup of the 590-Mb/d Trans Mountain Expansion Project (TMX) to Canada’s British Columbia coast, 180 Mb/d in planned expansions to Enbridge’s pipelines (150 Mb/d on the Mainline and 30 Mb/d on Express-Platte) by 2027, and higher utilization of the Mainline (maybe another 50 Mb/d), Western Canadian producers and shippers may well face a takeaway capacity crunch by late 2028 — only three years from now. In other words, keep those capacity-adding projects comin’!

In today’s blog, we assume that our production forecast is on point and that Enbridge will find shipper support for another 150 Mb/d in Mainline expansions, resulting in a total of 380 Mb/d of incremental flows down the Mainline and Express-Platte systems by the late 2020s (150 from initial Mainline expansion + 30 from Express-Platte expansion + 50 from Mainline efficiencies + 150 from future Mainline expansion). That all raises a new and important question: Where will that extra 380 Mb/d end up?

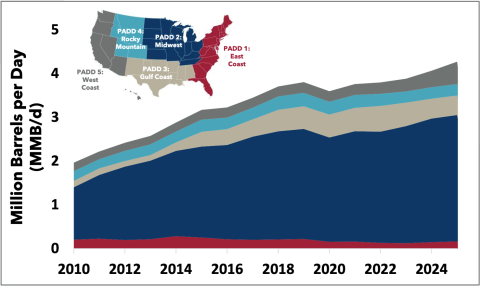

Let’s begin with a little background. Canadian crude oil exports to the U.S. have more than doubled over the past 15 years, from about 2 MMb/d in 2010 to 4.2 MMb/d in 2024. PADD 2 (Midwest/Great Plains) is by far the largest destination, accounting for two-thirds (or about 2.8 MMb/d; dark-blue layer in Figure 1 below) of last year’s total. Of the 2.8 MMb/d that ended up in PADD 2, ~2.3 MMb/d was heavy crude and the rest (~500 Mb/d) was light/medium crude — together, these types accounted for 73% of the more than 3.8 MMb/d of crude PADD 2 refineries received, on average, in 2024, with Western Canadian heavy accounting for 60% of their crude slate and Western Canadian light/medium making up 13%. (The 27% balance was U.S.-sourced light oil.)

Canadian Crude Oil Exports to the U.S. by PADD

Figure 1. Canadian Crude Oil Exports to the U.S. by PADD.

Sources: EIA and Canadian Association of Petroleum Producers

Join Backstage Pass to Read Full Article