It might seem crazy to talk about expanding crude oil and diluent pipeline systems between Canada and the U.S. amid what could escalate into an all-out trade war between the two nations. However, Enbridge, one of the largest pipeline operators in the world, is doing just that — actively planning and investing in pipeline expansions for its Mainline, Express-Platte and Southern Lights systems that would help move an ever-rising tide of Canada’s oil sands crude to market in the years ahead. We examine Enbridge’s plans in today’s RBN blog.

[It’s a compelling time to consider U.S. and Canadian hydrocarbon markets. As North America’s energy landscape continues to evolve, understanding the forces shaping crude, natural gas, and NGL markets has never been more critical. That’s why this year, RBN is heading north in this special School of Energy Canada session, set for August 26-27 in Calgary. Join us as we break down the latest market trends, production shifts, and infrastructure developments—giving you the insights you need to navigate the fast-changing energy sector on both sides of the border. Register today and save $500 with our Early Bird Rate. Click here for more information on School of Energy Canada.]

Unless you have been hiding under a rock for the past few months, you are probably all too familiar with trade frictions that have arisen between the U.S. and Canada as a result of the on-again, off-again imposition of tariffs on U.S. imports of goods from Canada, including vital supplies of energy (see Everybody Hurts). With the potential for a tariff rate of 10% on U.S. energy imports from its northern neighbor (and a 25% rate on other imported goods), the war of words and potential counter-tariffs imposed by Canada have served to upend what is the most successful bilateral trading relationship in the world. It has also led to not-so-veiled threats by Canada that its exports of crude oil, natural gas and electricity could be curtailed or cut off in retaliation.

With trade relations frayed and tensions still unresolved, you might wonder why any Canadian company might be considering — let alone actively pursuing — an expansion of pipeline capacity between the two nations for the movement of crude oil south to the U.S. and diluent north from the U.S. for use in Alberta’s oil sands. Nevertheless, one of the largest pipeline companies in the world, Calgary, AB-based Enbridge, is pursuing just such a strategy, betting that the long-term fundamentals of Western Canada’s crude oil supply growth will fully justify additional pipeline capacity across several of its systems that move crude oil and diluent between the two nations.

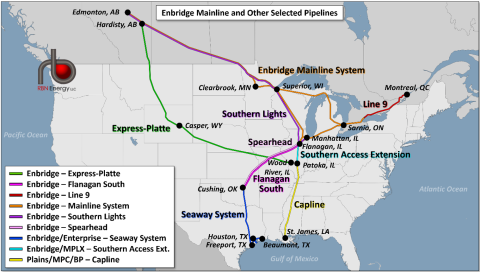

Let’s first take a quick tour of several Enbridge pipeline systems, which we will explore in this blog. The array of pipelines known collectively as the Enbridge Mainline (orange lines in Figure 1 below) handles about 70% of all the crude oil shipped from Western Canada by pipeline into the U.S. Midwest. The system’s parallel Lines 1, 2, 3, 4 and 67 transport a variety of heavy and light crude oil and NGLs from Edmonton and Hardisty, AB, to Clearbrook, MN, and Superior, WI. From there, other Mainline pipes move crude to the Flanagan hub in north-central Illinois (Line 61), the Chicago area (Lines 6, 14 and 64), Michigan (Lines 5 and 78) and Ontario (Lines 5, 7, 11 and 78). The U.S. side of the Mainline is often referred to as the Lakehead System.

Figure 1: Enbridge Mainline and Other Selected Pipelines. Source: RBN

Join Backstage Pass to Read Full Article