Moss Lake Partners has announced plans to build a massive 42-inch pipeline known as the DeLa Express to take up to 2 Bcf/d of wet gas 690 miles from the Permian across the Texas state line into Louisiana. It’s an audacious plan, and there’s little doubt that a new natural gas pipeline from the Permian to the Gulf Coast is needed to facilitate continued production growth but the proposal faces serious challenges. In today’s RBN blog, we discuss how investors, producers and potential shippers might approach this newcomer and gauge whether it’s a project that could go the distance or become just another pipe dream.

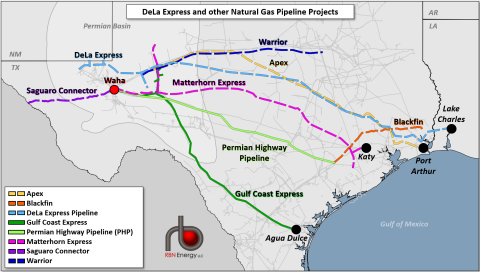

In RBN’s consulting practice we do a lot of work on market diligence — advising clients on our view of the long-term prospects for their various projects. As we said in Sold, that’s a big help for clients who don’t want to get surprised on a major investment. And by doing that kind of work and listening to the kinds of questions that people ask, it provides us insight into the current state of the market as well as which way the wind is blowing. Right now, there is a ton of work being done to identify the next set of pipelines out of the Permian. Determining the likely winners is a big deal and a lot of folks see that as an opportunity. And it is. We blogged about the stacked field of proposed natural gas pipes (shown in Figure 1 below) in our March Madness-themed Come Dancing blog and we’ll use a couple of basketball metaphors in this one too.

But building a pipeline ain’t easy. It requires a lot of careful planning and hard work by a lot of smart people to make these things happen. The big successful developers just make it look easy the way professional athletes make dunking look easy. Of course, it isn’t.

Even beyond the difficulty of the task, it takes a certain amount of chutzpah to try to compete in this space. The big guys have a huge natural advantage. But we’ve seen Cinderella teams like WhiteWater and EPIC come in and make big splashes versus the blue-chip players like Energy Transfer, Enterprise and Kinder Morgan. Chutzpah or not, developers try to defray their risk to the extent possible and that means getting a sufficient amount of contracts in place to support the financing of the facility. Those contracts can come in a lot of forms. For gas, it’s often firm transportation agreements. But producers and other potential shippers are hesitant to sign up for new gas capacity these days. And there are lots of good reasons why. Back in 2021, we talked about the dilemma of producers who want to ensure their production flows at reasonable prices but are reluctant to commit and referred to the concept as the Midstream Conundrum.

(This is going to be a little bit of a tangent but with this latest round of infrastructure buildout, we think it’s worthwhile to review the basics of the motivations and obstacles to midstream development. This will also serve as a setup for our discussion of DeLa.)

So what hinders producers and shippers from committing to a pipeline? First there’s the fear of overpaying. Shippers that sign up for firm transportation contracts agree to pay a reservation fee. They would make that commitment because they want to make sure that their volumes move and they know that if not enough shippers sign up then the pipe won’t get built which could inhibit the growth of their business or cause them to receive discounted commodity prices.

In a perfect world, the fee they pay would be less than the current spread between the supply point and the destination. But shippers know, as we’ve seen time and again, that when a spread is based on a bottleneck and you fix the bottleneck, the spread collapses (see Honey, I Shrunk the Basis). Nobody wants to be the guy holding the bag with firm rates that are out of the money, so producers and potential shippers have to carefully weigh that risk against the benefit of flow assurance for their production volumes.

That apprehension is heightened if there are risks of a production slowdown that could further dampen the spread between supply and demand. And the risk of a slowdown is top of mind — whether a result of capital discipline or acreage depletion. Paying a high fixed rate for firm capacity when there’s ample space for walkup shippers isn’t a good look. Even the surest bet in the oil patch of the last decade, Permian production growth, has questions swirling around it. (More on that in a future blog.) And overlaying both those concepts (production limitations and market disruptions) is the fear of regulatory uncertainty — that’s more true now than it was back then, especially for a pipeline like DeLa that proposes to cross a state line and thus be subject to Federal Energy Regulatory Commission oversight (see Not Giving In, Easier Said than Done, or Take Five).

And there’s one more thing that we didn’t mention back then because it hadn’t yet come to pass, but with the frenzy of upstream consolidation over the last year, the list of potential producers with the motivation and wherewithal to take out big chunks of capacity is now much shorter. Further, it’s likely that those larger players have planned ahead and given themselves optionality to flex onto other capacity if their Plan A goes sideways. So for example, when we see prices in the Permian get hammered negative due to outages on El Paso and Gulf Coast Express (GCX; see NATGAS Permian for details) like we have in the last few weeks, remember it’s the marginal btu shipped at Waha that’s being priced negative. The big, sophisticated players likely have asset optimization options, hedging programs and/or portfolios of firm capacity out of the region and aren’t taking the full brunt of it. So they don’t necessarily have to make a new commitment to firm capacity if they can juggle what they already have.

With that rather lengthy preamble out of the way, let’s get back to the DeLa pipeline.

Figure 1. DeLa and Other Proposed Permian-to-Gulf Coast Pipelines. Source: RBN

Join Backstage Pass to Read Full Article