The Jordan Cove LNG project in coastal Oregon is the first “greenfield” US LNG export project—and the first on the West Coast--to win the Department of Energy’s approval to export to non-Free Trade Agreement (FTA) nations. That approval is critical for an LNG exporter focused on Asian markets, because the only FTA countries in that region are South Korea and Singapore. But can Jordan Cove compete with Sabine Pass and other Gulf Coast projects with existing LNG tankage and therefore lower capital costs? Today we consider the economics behind the project.

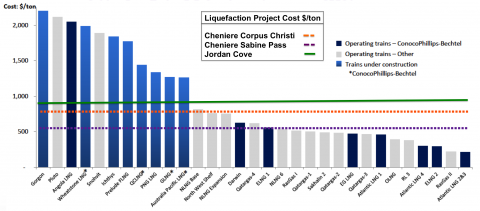

In the First Episode of this series, we discussed the race now under way among prospective LNG exporters in the US and Canada to secure needed regulatory approvals, lock in LNG buyers and gas suppliers, and build needed infrastructure. Veresen’s Jordan Cove project, a 6 MMTPA (or million metric tons per annum – about 800 MMcf/d) LNG export terminal (expandable to 9 MMTPA) planned for a site at the Port of Coos Bay, has both economic advantages and disadvantages when compared with Cheniere Energy’s Sabine Pass and other LNG export projects along the Gulf Coast, most of which involve converting existing LNG import terminals into import/export facilities. Capital costs at Jordan Cove will be higher on a dollars/MTPA basis (an estimated $900/MTPA; green line on graph in Figure #1) than a project like Sabine Pass that already has significant infrastructure in place (about $550/MTPA; purple dotted line) or Cheniere’s Freeport liquefaction project in Corpus Christi (about $800/MTPA; orange dotted line). But Jordan Cove’s cost/MTPA is considerably lower than those of several competitor projects now being built overseas, including the Gorgon, Wheatstone and Australia Pacific LNG projects in Australia (medium-blue bars toward the left of Figure #1).

Figure #1

Source: Cheniere Energy Presentation and RBN Energy (Click to Enlarge)

Jordan Cove’s capital cost disadvantage vis-à-vis its Gulf Coast competitors is offset by its relative proximity to Asia. The nine-day trip from Jordan Cove to Asia (versus 22 days from the Gulf Coast) will slash shipping costs; LNG ships cost more than $80,000/day to charter, so saving 26 days round trip would save more than $2 million. Ships traveling to and from Jordan Cove also will avoid the hefty Panama Canal fees (an estimated $900,000/voyage) that Gulf Coast/Asia milk run shippers will need to pay—and whatever congestion the canal may experience when its expansion is completed in 2016. Cheniere Energy, the developer of Sabine Pass, expects LNG shipping from Louisiana to Asia to cost about $3/MMBtu. Since an average LNG carrier holds close to 3 Bcf (approximately 3 million MMBtu) of gas, with travel distance savings of $2 million and canal saving of $0.9 Million, the cost from Jordan Cove would be $2.9 million / 3 million MMBtu or nearly $1/MMBtu lower.

|

|

RBN FUNDAMENTALS WEBCAST THIS WEEK! Mark Your Calendars RBN Energy’s inaugural Fundamentals Webcast for Backstage Pass subscribers has been scheduled for Thursday, May 8th at 2:30pm central time. In this session, Rusty Braziel will provide a brief market update for crude oil, natural gas and NGLs, highlighting a new outlook for Permian production, the potential impact of emerging ethane exports, and the latest on Marcellus/Utica take-away capacity. |

Like most of its Gulf Coast rivals, Jordan Cove’s business model is based on entering into liquefaction tolling agreements (LTAs) under which an individual customer that holds title to gas will have the right to deliver that gas to the Jordan Cove terminal for liquefaction services and to receive LNG in exchange for a processing fee paid to Jordan Cove. This tolling arrangement removes Jordan Cove’s exposure to so-called “molecule risk” – the risk of owning gas that changes value as prices move up and down. What toll costs will be involved in Jordan Cove’s LTAs? Those details have yet to emerge. The charge for converting delivered gas into LNG at the planned Gulf Coast terminals ranges from less than $3 to about $3.50/Mcf. The liquefaction toll is typically “take-or-pay”; that is, the LNG buyer pays for a set amount of liquefaction capacity whether or not it ends up using all that capacity. Also, LNG buyers generally pay the export terminal owner an additional fee equal to 15% of the fluctuating hub price for the gas that passes through the facility. For example, the charge for 3 Bcf – the equivalent of one LNG shipment –of $5 gas would be $2.25 million.

Join Backstage Pass to Read Full Article