Exporting LNG from western Canada to the Pacific Rim is seen by many as the silver bullet for reinvigorating Canada’s ailing natural gas sector. But while Canadian LNG may prove to be a cost-competitive alternative for buyers in Japan, Korea and other big consuming nations, prospective LNG exporters up north are certain to face stiff competition from Australia, the U.S., and other low-cost, high-volume gas producers. The point is, a silver bullet can miss its target. What if Canada’s aim is off?

In Part 1 of “More than a Feeling?” we looked at how Canada’s traditional role as a marginal gas supplier to the Lower 48 is being undone by increasing U.S. gas self-sufficiency. We also considered the changing dynamics of Canadian gas supply and demand, and the plans to build several LNG export facilities in British Columbia. In the second part of the series, we look at where Canadian LNG exporters hope to find buyers, and at the challenges they may face.

Canada has vast reserves of natural gas, but gas production there is sagging as the volume of gas it exports to the U.S. continues to fall. Bentek figures that in the 2013-18 period, Canada-to-U.S. exports will fall another 1.9 Bcf/d, to 3.1 Bcf/d, and that while rising in-Canada demand for gas will make up for some of that loss, the only way to return the Canadian gas market to a balanced state would be to export the equivalent of at least 1.1 Bcf/d as LNG by 2018, and to ship increasing amounts after that. That is a tall order, and Canada’s own National Energy Board said in a May report that some LNG projects are taking longer than expected to obtain sales commitments from gas buyers overseas, and that some gas development in western Canada is likely to be postponed as a result.

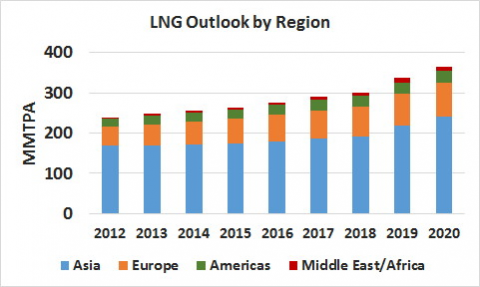

There is good news and bad out there for western Canadian gas producers hoping for an LNG export boom. Natural gas is becoming an increasingly important fuel overseas. Gas already accounts for 21.5% of worldwide energy demand, with about 70% of the gas traded internationally moving through pipelines, and the other 30% transported as LNG. In a May report prepared for the ExxonMobil/Imperial Canadian LNG export application, PFC Energy sees global demand for LNG rising from 240 million metric tonnes (MMT) in 2012 to 366 MMT in 2020. Asia, the logical market for LNG exports from western Canada, accounts for about two-thirds of global demand now, and that will likely continue: Asian demand for LNG is expected to grow from 168 MMT in 2012 to 240 MMT in 2020 (see Figure 1).

[Note: To convert volumes of LNG in MMT (millions of metric tons) to MMcf/d (millions of cubic feet per day), multiply by 142; The math works as follows --- 1 LNG gallon weighs 3.5 lbs. So 1 LNG ton = 2,200 lbs / 3.5 = 621 LNG gallons per LNG ton; 1 LNG Gallon = 82.6 standard cubic feet of natural gas; so 621 * 82.6 = 51,294 cubic feet/ton; then divide by days in a year --- 51,294/365 = 142 cf/day. Thus one ton LNG per year = 142 cf/d of gas. For example, 240 MMT = 34 Bcf/d. One other note. MMT is also sometimes abbreviated as MMTPA, or millions of metric tons per annum.]

Figure 1- Source: PFC Energy (Click to Enlarge)

Japan is by far the world’s largest LNG importer, bringing in 88 MMT last year, and South Korea and Taiwan have been—and will remain—big consumers as well. Unless Japan and Korea turn away from nuclear power and toward gas-fired generation, however, the real growth in Asian LNG demand is likely to come from the giant and growing economies of China and India. China is expected to increase from 15 MMT in 2012 to 50 MMT in 2020 while Indian demand could increase from 13 MMT in 2012 to 36 MMT in 2020.

Join Backstage Pass to Read Full Article