Canada enjoys vast natural gas resources and domestic demand for its gas is growing. But Canadian gas exports to the U.S. are plummeting, and it seems the only way to avoid a major gas glut north of the border will be to export large volumes of LNG to the Pacific Rim. The catch is, there’s a lot of competition out there, both from reigning LNG export giants like Australia and prospective players like the U.S. And Canada has its own issues with environmental concerns and permitting for natural gas pipelines and LNG terminals. What happens if Canada’s LNG export initiatives don’t happen?

In this, the first part of our two-part series, we examine how Canada’s long-standing role as a marginal gas supplier to the Lower 48 has been up-ended by increasing U.S. gas self-sufficiency. We look at the changing dynamics of Canadian gas supply and demand, and the plans to build several LNG export facilities in British Columbia. In the second part of the series, we’ll look at where Canadian LNG exporters hope to find buyers, and assess the aggressive, low-cost competition that may stand in their way.

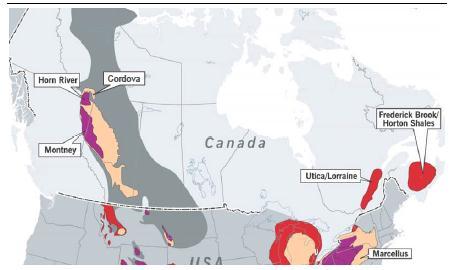

Canada has about 600 Tcf of natural gas reserves, nine-tenths of it in western Canada. For years, conventional gas has dominated Canadian production, but that’s been changing—and quickly—because shale gas is much less expensive to produce (on a per-unit of production basis). Most of Canada’s shale gas is in the Horn River/Liard basins in northeastern British Columbia, and in the Montney play in northeastern BC and Alberta (see Figure 1). Demand for gas within Canada, currently at about 9 Bcf/d, is seen growing by a healthy 3%/year, on average, for the foreseeable future, led by growth in demand for gas for oil sands bitumen production, power generation, and—Canadians hope, longer term—conversion into LNG for export to Japan, South Korea and other major consumers across the Pacific. Most of the ramp-up in LNG exports is seen occurring in the 2020s.

Figure 1 - Source: Energy Information Administration (click to enlarge)

Until a Canadian LNG export market develops in earnest later this decade, growth in domestic gas demand up north won’t be nearly enough to counteract the ongoing collapse of gas exports to the U.S. The culprit, of course, is the sharp increase in U.S. shale gas production, and the construction of new pipelines to deliver U.S. gas to U.S. buyers. Western Canadian gas that used to flow to California, the Midwest and the Northeast is being displaced by shale gas produced much closer to those buyers. And low-cost gas from the Marcellus is now pushing into eastern Canadian markets at Niagara (See Return to Sender). Net Canadian exports to the U.S. totaled only 5.4 Bcf/d in 2012, down 45% from their peak of 9.9 Bcf/d in 2002. That downward trend will only continue; Bentek, for one, expects Canadian gas exports to the U.S. to fall to 3.1 Bcf/d by 2018. (Overview, Bentek’s Global Thirst for North American Shale Gas report.) Because of declines in gas exports to the U.S., Canadian gas production has fallen from 17 Bcf/d in 2000 to 13 Bcf/d this year, and it’s expected to remain flat until the end of this decade, when LNG exports are expected to take off. By 2025, some see Canada producing 20 Bcf/d, and still-higher production levels are clearly possible—if the LNG export boom actually happens.

The expansion of Canada’s LNG export market is seen growing slowly through the latter half of the 2010s, then soaring early in the next decade. Three projects planned for sites along British Columbia’s northern coast already have secured LNG export licenses from Canada’s National Energy Board. One is Kitimat LNG, a proposed terminal in Kitimat, British Columbia, planned by Apache Canada and Chevron Canada that would export LNG equivalent to 1.4 Bcf/d starting as soon as late 2017. Another is Douglas Channel, a barge-based liquefaction plant and terminal near Kitimat being co-developed by the Haisla First Nation (a Native American group) and LNG Partners; as soon as mid-2015 it could be exporting the equivalent of about 0.1 Bcf/d, and its capacity could triple over the following few years. A joint venture of Royal Dutch Shell, Korea Gas, Mitsubishi and PetroChina, meanwhile, holds an NEB license to export up to 3.2 Bcf/d from the planned LNG Canada export terminal—also in Kitimat--that would begin coming online in 2019 or 2020. Bentek sees in-service LNG export capacity at the Douglas Channel and Kitimat LNG terminals rising to 0.9 Bcf/d by late 2017, and nearly 1.6 Bcf/d by mid-2018 (see Figure 2).

Join Backstage Pass to Read Full Article