In the race to build the next deepwater crude oil export terminal in the Gulf of Mexico, Sentinel Midstream’s proposed Texas GulfLink (TGL) is currently in second place in the regulatory race, behind only Enterprise’s Sea Port Oil Terminal (SPOT) — and seems to be emerging as a serious contender. The plan offers some compelling attributes, including Sentinel’s status as an independent midstream player and plenty of pipeline access to crude oil volumes in the Permian and elsewhere. In today’s RBN blog, we turn our attention to TGL and what it brings to the table.

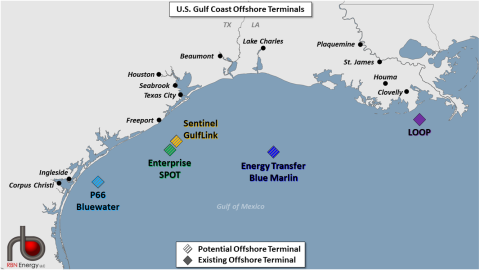

This series has focused on the plans to build one or more deepwater crude oil export terminals as well as their inner workings. Part 1 made the case for constructing at least one of the four projects now under development. As we’ve blogged about often (see May Exports Be With You), U.S. crude export volumes took off in the 2010s and are expected to continue growing along with production throughout the 2020s, driving the market to seek the most efficient export options. The projects under development offer a number of potential benefits to shippers and customers alike. But given all the potential upside of the deepwater projects, why hasn’t anyone fully committed to building one by making a final investment decision (FID)? We focused on those challenges in Part 2. The biggest may be price, as these projects are expensive and are likely to require significant term commitments to proceed, which is likely to limit the pool of potential customers to a select number of companies. The other major obstacle is the regulatory process, which can stretch for years. That’s where SPOT (striped green diamond in Figure 1 below), the focus of Part 3, has a significant leg up on its competition: Sentinel’s Texas GulfLink project (striped yellow diamond), Energy Transfer’s Blue Marlin project (striped dark-blue diamond), and Phillps 66 and Trafigura’s Bluewater project (striped light-blue diamond). SPOT received its deepwater port license on April 9. With the license in hand, it enables Enterprise to move forward to the next step in developing the offshore terminal.

Figure 1. Proposed U.S. Gulf Coast Offshore Terminals. Source: RBN

This is not the first time we’ve talked about the TGL project (see Catch a Wave), but let’s refresh our memory and start with the basics. TGL is planned for deepwater a little over 30 nautical miles off the coast of Freeport, TX, similar to SPOT. According to Sentinel’s application submitted to the U.S. Maritime Administration (MARAD), the port is designed to be capable of loading crude onto a Very Large Crude Carriers (VLCC) at a rate of up to 85 Mbbl per hour, equivalent to about 2 MMb/d.

Join Backstage Pass to Read Full Article