More than 9 billion gallons of propane were delivered to U.S. consumer markets in 2024, primarily for residential heating and cooking. Demand is highly seasonal, which brings a unique set of challenges for buyers, especially on the wholesale side of the market, but production tends to be steadier over the course of the year. In today’s RBN blog, we show how wholesalers balance supply and demand and the critical role of the winter-to-summer ratio.

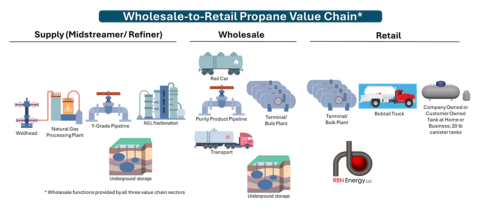

This is the fourth blog in our series about propane markets. In Part 1, we outlined the journey of propane from wellhead to burner tip. We discussed the various segments of the domestic propane market, including industrial, petrochemical, commercial, residential and agricultural demand. We also introduced the role of wholesalers and retailers. In Part 2, we detailed the role of wholesalers (middle column in Figure 1 below), whose primary function is to aggregate supplies, operate logistics networks, trade propane and integrate midstream operations. (Recently, in Should I Stay Or Should I Go?, we addressed some of the issues facing wholesalers today.) In Part 3, we introduced how retailers (right column) get their product and then sell and deliver it to the final customer. In today’s blog, we will cover the seasonal nature of propane demand and how it impacts contracting activity.

Figure 1. Wholesale-to-Retail Propane Value Chain. Source: RBN

One of the most important things to consider when looking at contracting mechanisms for wholesalers and retailers is the winter-to-summer ratio, which reflects the difference in propane lift volumes between the six winter months (contractually October through March) and the six lower-demand months (April through September). While some large retailers can rely on storage to manage some of the seasonal differences in demand, it is mostly the wholesaler that meets the need by contracting for supply that varies seasonally. The purchasing pattern is essential since propane demand is highly seasonal in most of the country. A typical retailer’s residential customer ratio is 2.5:1 but can range from as low as 1:1 in very warm locations (such as Florida or South Texas) to 5:1 or higher in very cold climates (such as the Upper Midwest or New England). More typical ratios are 2:1 or 3:1. As a general rule at a given location, the higher the ratio, the higher the price differential charged by the wholesaler to the retailer.

An example of a contract with a 2.5:1 ratio is shown in Figure 2 below. In this example, the average of all months is 1.0 (dotted red line), using an index. The winter index rises to almost 2.0 and the summer index drops below 0.5. The average for the winter months is 1.423 (solid green lines), and the average for the summer months (blue line) is 0.577. If we divide the winter ratio by the summer ratio, we get 2.5:1.

Join Backstage Pass to Read Full Article